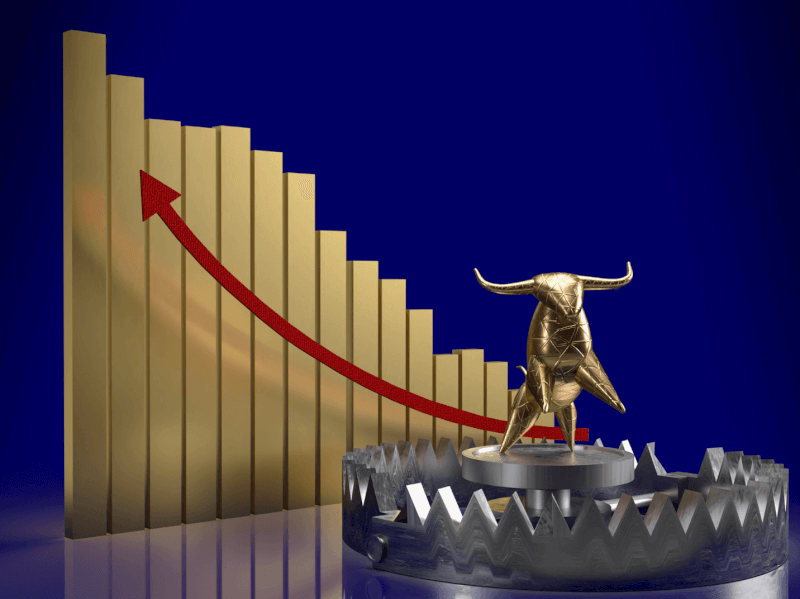

After two consecutive months of net outflows, foreign portfolio investors (FPIs) have reversed course and infused Rs 26,565 crore into Indian equities in June. This surge is attributed to political stability and a sharp market rebound.

Vipul Bhowar, Director of Listed Investments at Waterfield Advisors, noted that future FPI flows will likely hinge on the upcoming Budget and Q1 FY25 earnings reports, which will be critical in determining the sustainability of this trend.

According to depository data, FPIs injected a net Rs 26,565 crore into equities this month. This follows a net outflow of Rs 25,586 crore in May, driven by electoral uncertainties, and over Rs 8,700 crore in April, due to concerns over changes in India’s tax treaty with Mauritius and rising US bond yields.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, highlighted that the combination of political stability and a strong market rebound has compelled FPIs to become net buyers in India.