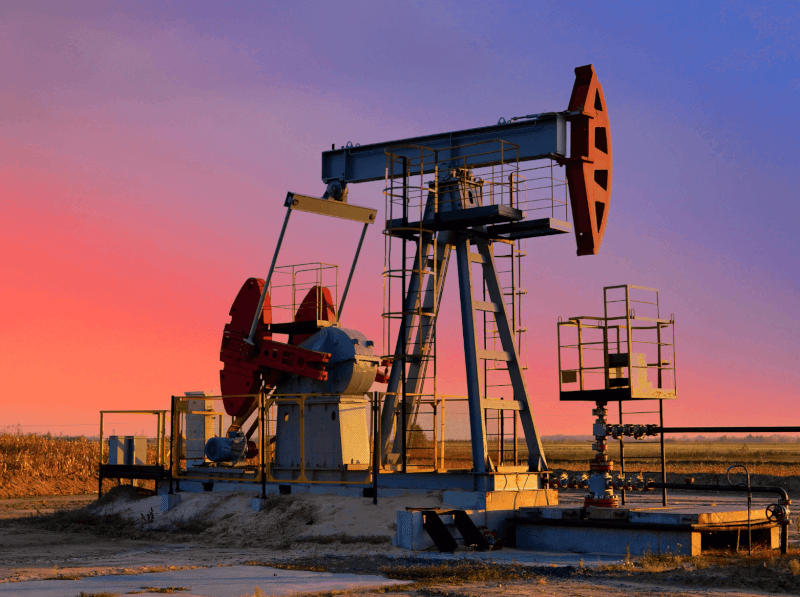

Most stock market indices in the Gulf Cooperation Council (GCC) region ended June on a positive note, driven by higher energy prices.

The Gulf’s equity markets were also supported by gains in blue-chip stocks, according to Kuwait Financial Centre’s (Markaz) monthly market review for June 2024.

Towards the end of June, crude oil prices surged to a near two-month high, fueled by expectations of higher demand during the summer period. On Tuesday, US crude hit $84.38, the highest since April 26.

Big Gainers

The S&P GCC composite index registered a gain of 2.5% for the month. Among the big gainers in June, the Qatar equity index rose by 7%, supported by strong non-oil economic activity and stable natural gas prices, while the Abu Dhabi equity index posted a 2.2% increase, and Saudi Arabia and Dubai rose by 1.5% and 1.3%, respectively.

The Kuwaiti index dipped during the period despite recent positive economic data, although it remained positive on a year-to-date basis.

“Most of the GCC stock market indices were positive during the month supported by the rise in oil price and gains in blue chips,” the Markaz report noted.

Expert Insights

Vijay Valecha, Chief Investment Officer at Century Financial, highlighted the resilience of the energy markets: “Despite the significant volatility in the first half of the year, the energy markets, mainly crude oil, have shown remarkable resilience. The 16% year-to-date rally, following a stellar Q1 gain of 17%, was momentarily interrupted during the correction in April and May. However, as has been the trend, geopolitical stress points once again bolstered oil prices, leading to a 6.5% gain in June and restoring the market’s allure.”

Valecha further elaborated on the overall prospects: “Middle Eastern tensions and the ongoing Russia-Ukraine conflict continue to provide anchor support to the oil markets. This is an additional tailwind on top of the OPEC+-led supply cuts, which have significantly tightened the market supply. This is visible in the current time spreads for WTI & Brent, with the backwardation scenario still alive and in play. Over to the core demand and supply dynamics, the latest monthly report by IEA points to a modest reduction in demand by 100 Kbpd to 960 Kbpd. This is lower than the official OPEC report’s estimates, which see oil demand unchanged at 2.25 Mbpd for 2024. In either case, the tightness in the oil market seems to be the underlying tone for the current year. The global supply is expected to rise by 580,000 kbpd, lower than previous estimates of 770,000 kbpd.”

Valecha concluded with a bullish outlook for oil prices: “The markets will likely overlook any significant news from the core macro side and instead focus on the ongoing geopolitical flash points and tensions. From a technical perspective, the market eagerly awaits Brent to clear the crucial resistance high zone of 87-88. A successful break above this level could pave the way for oil prices to retest the $90 zone, offering a promising future for the market.”

Sector Performance

In Saudi Arabia, the positive performance was supported by gains in banking stocks. The Saudi National Bank and Al Rajhi Bank rose by 7.1% and 5.1%, respectively.

The gains in blue chips propped up the Dubai equity index last month. Emaar Properties gained 7% amid plans to invest $408 million in the expansion of Dubai Mall, while Emirates NBD gained 6.1%.

In Abu Dhabi, the month of June was favorable to major players in the real estate and banking sectors, with Aldar Properties gaining 13.8% and First Abu Dhabi Bank scoring a 7.4% gain.

In Qatar, the real estate sector has also been upbeat over the past couple of months, with the number and value of transactions rising by 60% and 55%, respectively, in May compared to April 2024.