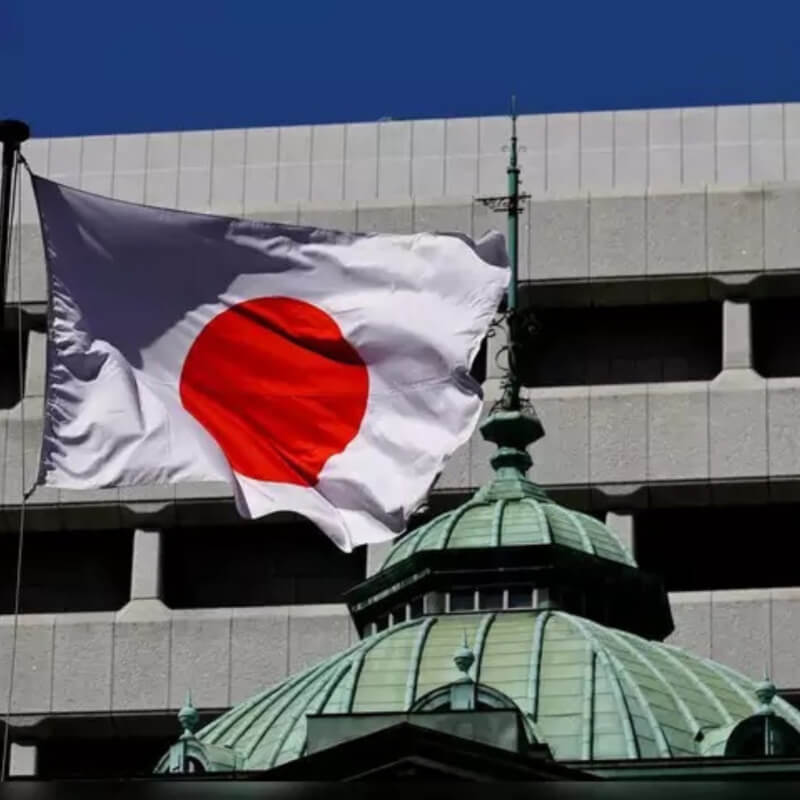

As July comes to a close, the Bank of Japan (BOJ) raises its benchmark interest rate to approximately 0.25%, a notable hike from the previous rates that fluctuated between 0 and 0.1%. This landmark interest rate hike serves as the highest jump in rates since October of 2008. These rates also signal a tapering of Japan’s bond buying program, which ties into its “virtuous cycle” of increasing prices and wages in the economy.

The Japanese fiscal year commences on April 1st and ends on March 31st. Therefore, the 2024 fiscal will end in March 2025. In a statement, BOJ elaborated on the significant adjustments made to interest rates, stating that they expect real interest rates to remain “significantly negative,” adding that “accommodative financial conditions will continue to firmly support economic activity.” According to highlights from CNBC, “the central bank forecasts that the core inflation rate—which strips out prices of fresh food—will reach 2.5% by the end of the 2024 fiscal year and “around 2%” for the 2025 and 2026 fiscal years.”

The BOJ stressed the importance of cementing a “virtuous cycle” by ensuring a steady rise in wages across the nation, observed among large players and SMEs. In a recent announcement, Rengo, the Japanese Trade Union Confederation, informed the nation that firms with 300 or more union-backed employees will receive a 5.19% wage rise. Additionally, smaller firms in Japan are expected to increase pay by 4.45%. The BOJ statement stressed adopting a leaner monetary policy that would result in a monthly reduction in the outright purchase of bonds to about 3 trillion yen ($19.64 billion) per month in the January to March 2026 quarter.