In May 2024, SoftBank’s group subsidiary Arm announced plans to design AI chips. Recent negotiations with Intel to spearhead mass production of Arm-designed chips fell through in light of Intel’s drastic cost-cutting plans, including thousands of layoffs, in early August.

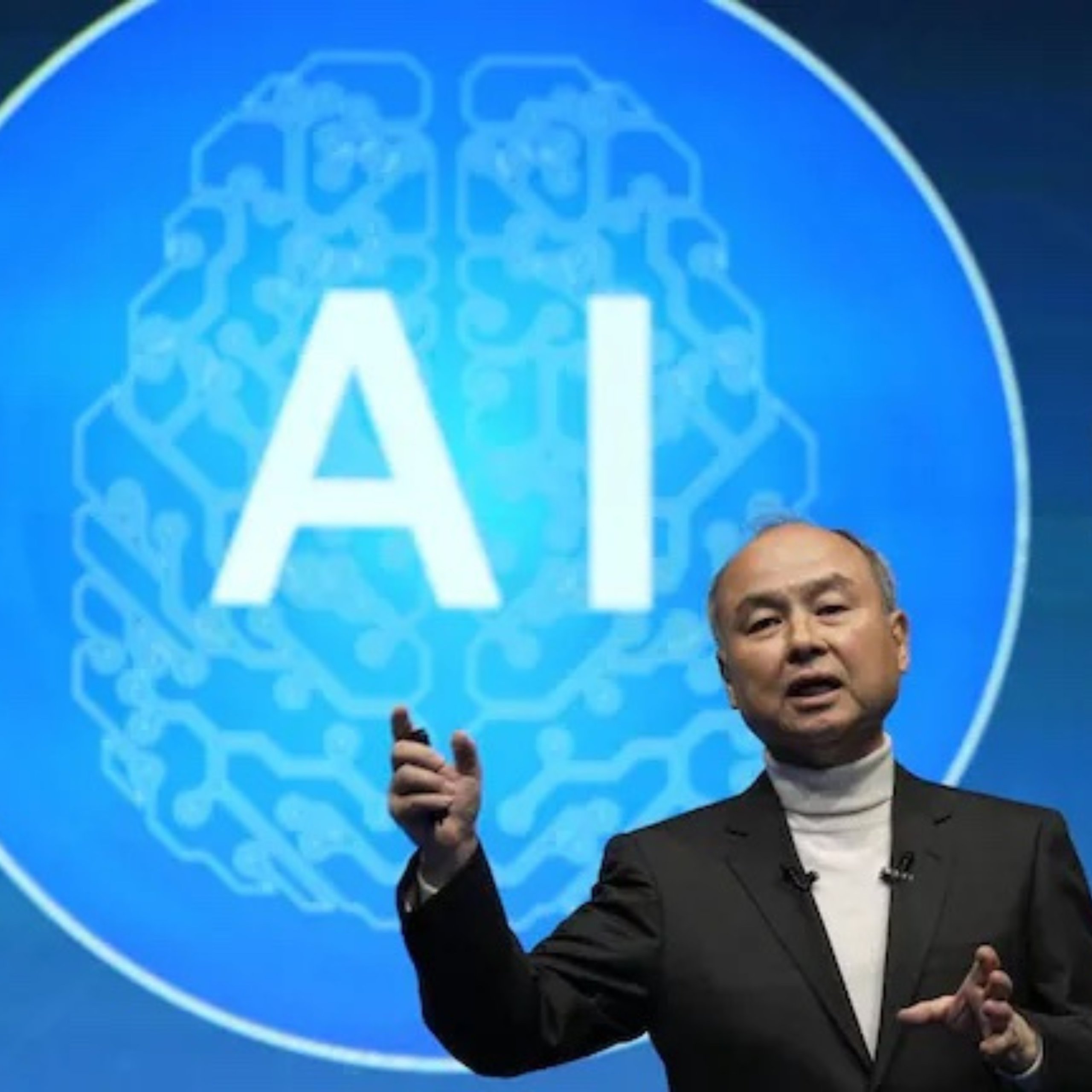

SoftBank’s chief executive, Masayoshi Son, is geared to invest billions of dollars in an attempt to position Japan as a leader in the global AI chip race. Masayoshi Son’s ambitious scheme aims to create an efficient AI chip ecosystem founded in Japan that encompasses chip production and software through to providing power for the data centers that would house its processors. Recent cost cuts at Intel prompted SoftBank to take its AI business to Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chipmaker. Financial Times informs that SoftBank “blames Intel for the collapse of the talks,

claiming the chipmaker was incapable of meeting its demands for volume and speed. They also cautioned the talks could start again given the limited number of chip manufacturers with the capabilities needed to produce cutting-edge AI processors.”

Son’s relentless aim to emerge as a global name in the AI chip race led to the Japanese multinational investment holding company pitching to the likes of Google and Meta to fund part of the venture. Several critics of Son’s AI chip scheme believe placing Arm at the forefront of SoftBank’s AI ecosystem might meddle with its relationship with key clients like Nvidia that Son sims to outpace eventually. By dropping Intel from its ambitious AI chip scheme, SoftBank forewent the opportunity to tap into the Biden administration’s Chips Act funding.

As talks progress, sources close to Son confirm that SoftBank intends to roll out a prototype by the end of the year. SoftBank’s recent purchase of UK-based AI chipmaker Graphcore is expected to expedite the development of the same. Intel’s waning dominance as a global chip foundry becomes glaringly evident as it revealed a $70 billion operating loss in its manufacturing segment in April of this year.