Weaker U.S. jobs data and renewed ceasefire talks in Gaza weigh on oil market, despite a slight uptick in prices.

Oil prices edged higher on Friday, but the market is on track to close the week with losses as concerns over U.S. demand and easing supply fears influenced trading. Weaker-than-expected U.S. employment data raised questions about the economic health of the world’s largest oil consumer, while renewed ceasefire negotiations in Gaza reduced anxiety over potential disruptions to oil supply.

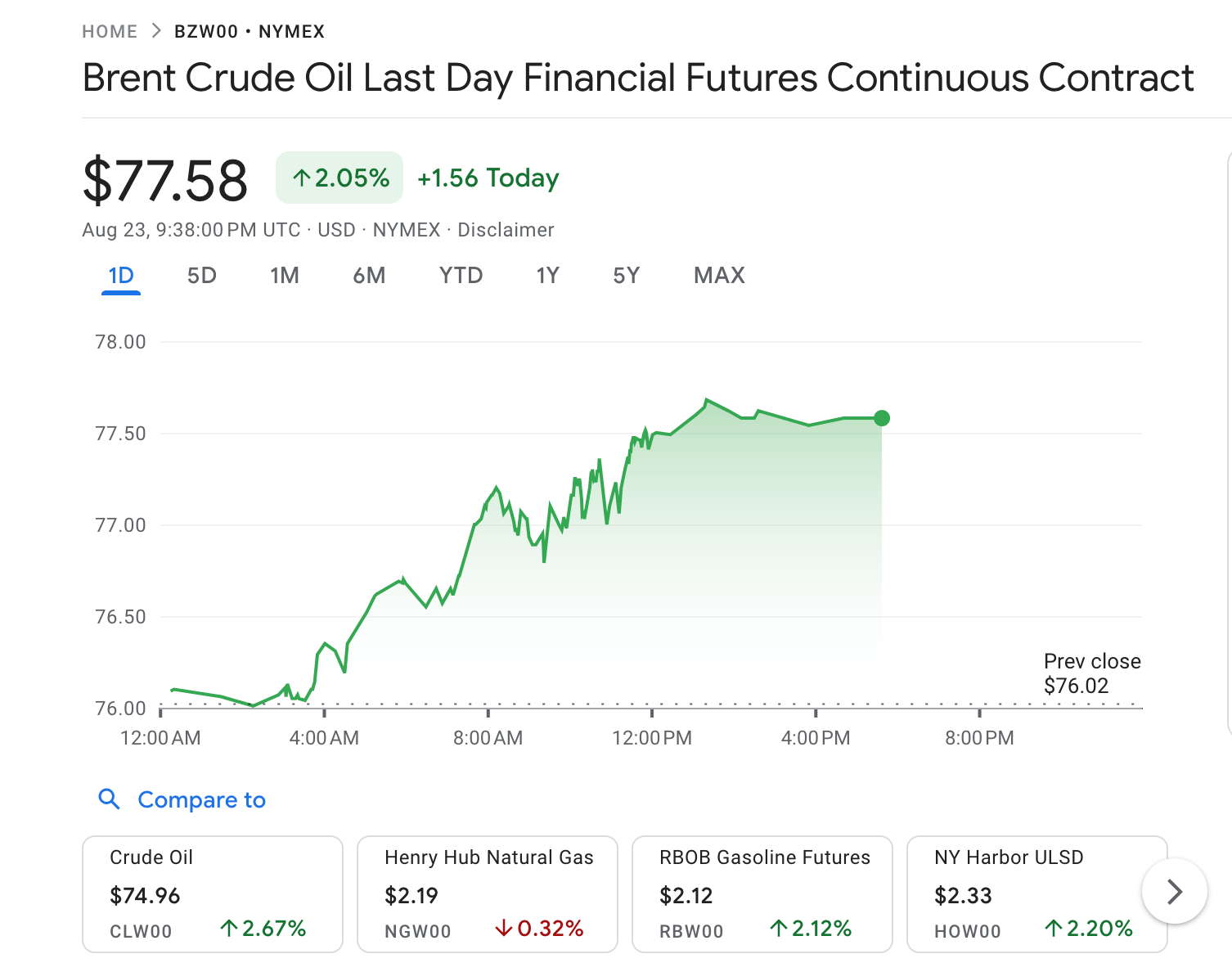

Brent crude futures increased by 67 cents, or 0.9%, reaching $77.89 a barrel as of 0932 GMT. Meanwhile, U.S. West Texas Intermediate (WTI) crude futures rose by 69 cents, or 1%, to $73.70. Despite these gains, Brent crude is down approximately 2% this week, while WTI has seen a decline of nearly 4%.

This week, both oil benchmarks touched their lowest levels since early January after the U.S. government significantly lowered its estimate of job additions for the year up to March. This adjustment sparked fears of a potential recession in the U.S., which could dampen oil demand in the world’s largest oil-consuming nation. However, some market analysts suggest the market may have overreacted to the jobs data revision.

Market participants are also awaiting a keynote speech by Federal Reserve Chair Jerome Powell, scheduled for 1400 GMT on Friday. There is widespread anticipation of an upcoming interest rate cut, which could impact economic activity and, consequently, oil demand.

Morgan Stanley noted in a report on Friday that a recent drawdown in oil inventories has provided some support to oil prices. “Currently, the balance in the oil market is tight, with inventories drawing approximately 1.2 million barrels per day over the last four weeks. We expect this trend to continue throughout the remainder of the third quarter,” the bank stated.

However, concerns over demand persist, especially with recent economic data from China, the world’s largest oil importer, indicating a sluggish economy and reduced oil demand from refiners. Additionally, renewed efforts for a ceasefire in Gaza between Israel and Hamas have alleviated some supply fears, further weighing on oil prices.

On the geopolitical front, U.S. and Israeli delegations began a new round of discussions in Cairo on Thursday, aimed at resolving differences over a proposed truce in Gaza. The progress in these talks has contributed to a more stable outlook for oil supplies in the region, adding downward pressure on prices.

As the week concludes, oil traders are keeping a close watch on economic signals from major consumers and geopolitical developments that could influence supply dynamics in the global market.

Warren Buffett’s Berkshire Hathaway Surpasses Federal Reserve In U.S. Treasury Bill Holdings