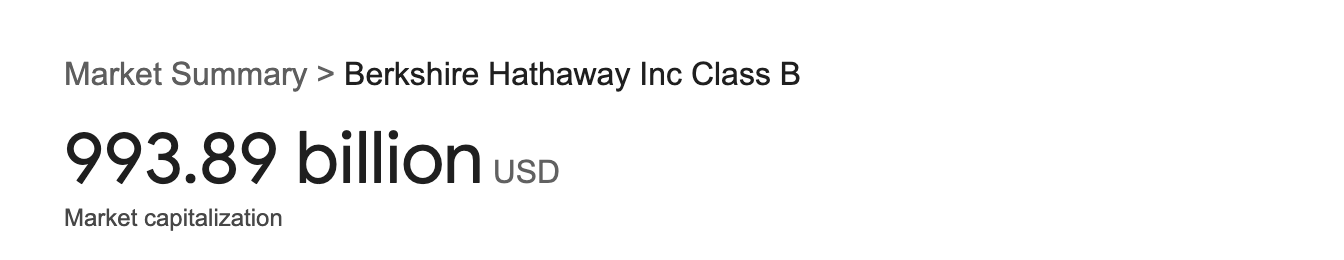

Warren Buffett’s Berkshire Hathaway reached a $1 trillion market capitalization on Wednesday, marking the first non-technology company in the United States to achieve this milestone. This achievement highlights the unique position of Berkshire Hathaway in the market, driven by its diverse portfolio of businesses and conservative financial strategy.

Image | Google Finance

Key Highlights of the Milestone

- Surpassing $1 Trillion Market Cap: Berkshire Hathaway’s shares surged to $696,502.02, pushing the company’s market value past the $1 trillion threshold, according to FactSet data. This makes Berkshire Hathaway the seventh U.S. company to join the trillion-dollar club, a notable feat considering the other six companies—Apple, Nvidia, Microsoft, Alphabet, Amazon, and Meta—are all technology giants.

- Performance in 2024: Shares of the Omaha-based conglomerate have risen more than 28% in 2024, significantly outperforming the S&P 500’s 18% gain. This rally has been fueled by Berkshire’s robust business performance and its extensive holdings across various industries, including insurance, railroads, retail, manufacturing, and energy.

- Old Economy Strength: Unlike its trillion-dollar peers, Berkshire Hathaway is known for its “old economy” focus, with significant ownership stakes in companies such as BNSF Railway, Geico Insurance, and Dairy Queen. Despite this traditional focus, Berkshire’s substantial position in Apple has contributed to its recent market gains.

- Buffett’s Leadership and Strategy: Warren Buffett, who took control of Berkshire in the 1960s and transformed it from a struggling textile manufacturer into a diversified conglomerate, is credited with this achievement. His management style and investment philosophy have built a company with an unmatched balance sheet and cash reserves. Greg Abel, vice chairman of Berkshire’s non-insurance operations, has been named Buffett’s successor, with Buffett confirming that Abel will have the final say on investing decisions once he steps down.

- Financial Strategy and Recent Moves: Berkshire Hathaway has been strategically increasing its cash reserves, reaching a record $277 billion by the end of June. This includes a significant holding in short-term Treasury bills, which totaled $234.6 billion at the end of the second quarter. This defensive positioning has been interpreted by some analysts as a cautious stance on the current economic environment and market valuations.

- Stock Sales and Investments: Recently, Berkshire has been selling off portions of its stock holdings, including a substantial reduction in its Apple stake and a $5 billion sale of Bank of America shares. This selling spree, coupled with its massive cash holdings, suggests that Berkshire is positioning itself to weather potential economic uncertainties.

- Strong Earnings and Future Projections: Following Berkshire’s strong second-quarter earnings, UBS analyst Brian Meredith raised his 2024 and 2025 earnings estimates for the company, citing higher investment income and better underwriting results in its insurance group, including Geico. Meredith also increased his 12-month price target for Berkshire’s Class A shares to $759,000, projecting further growth beyond the $1 trillion market cap.

Berkshire Hathaway’s Unique Market Position

Berkshire Hathaway’s journey to a $1 trillion market cap underscores its distinctive position in the American business landscape. While tech companies have dominated the trillion-dollar club, Berkshire stands out due to its diversified business model and conservative financial management.

Unlike most publicly traded companies, Berkshire Hathaway’s original Class A shares are among the most expensive on Wall Street, with each share priced significantly higher than the median price of a home in the U.S. This high share price is a deliberate strategy by Buffett to attract long-term, quality-oriented investors, though Berkshire did issue Class B shares in 1996 to make its stock more accessible to smaller investors.

Image | Google Finance

Looking Ahead

As Berkshire Hathaway continues to adapt to evolving market conditions, its strong financial position and diverse portfolio offer a solid foundation for future growth. Investors view Berkshire as a reliable investment in uncertain economic times, given its substantial cash reserves and prudent management approach. With Greg Abel set to take the reins in the future, the company is well-positioned to maintain its legacy of stability and steady returns in the years to come.

Warren Buffett’s Berkshire Hathaway Surpasses Federal Reserve In U.S. Treasury Bill Holdings