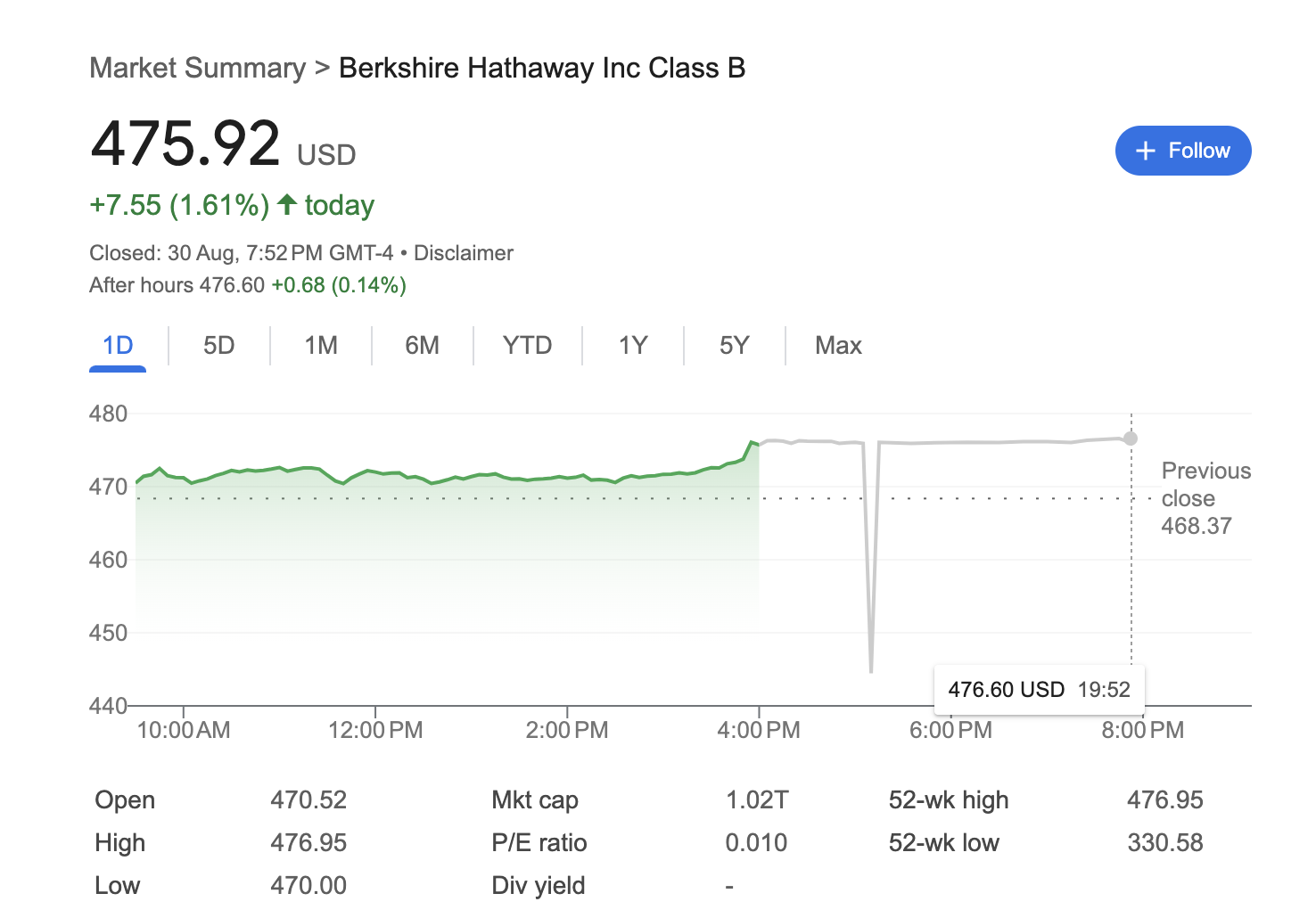

Warren Buffett, renowned as the “Oracle of Omaha,” celebrated his 94th birthday this past Friday, leading his conglomerate, Berkshire Hathaway, to its highest valuation ever. For the first time, Berkshire Hathaway, known for its diverse range of businesses, reached a market capitalization of over $1 trillion, making it the first non-technology company to achieve this milestone. Additionally, Berkshire’s Class A shares topped $700,000 each, setting another record.

A Legacy of Investment Brilliance

Buffett’s journey with Berkshire Hathaway began in the 1960s when he transformed a struggling New England textile company into a vast conglomerate. Today, Berkshire Hathaway is a powerhouse, encompassing a variety of businesses, from GEICO insurance to BNSF Railway, and holds an equity portfolio worth over $300 billion along with a cash reserve of $277 billion.

Iconic Investment Moves

Throughout his career, Buffett has made several high-profile investments that have demonstrated his adaptability and investment acumen. His purchase of Coca-Cola shares in the late 1980s showcased his preference for strong brands with wide moats, while his significant investment in Goldman Sachs during the 2008 financial crisis highlighted his ability to capitalize on market downturns. More recently, Buffett’s major stake in Apple, and his decision to reduce that stake, demonstrated his willingness to adapt his investment strategies to new market realities.

Under Buffett’s leadership, Berkshire Hathaway shares have achieved a staggering 19.8% annualized return from 1965 to 2023, vastly outperforming the S&P 500’s 10.2% return. In cumulative terms, Berkshire’s stock has risen by an astonishing 4,384,748%, compared to the S&P 500’s 31,223% over the same period.

Image | Berkshire Hathaway Market Summary via Google Finance

Patience and Discipline

One of the keys to Buffett’s success has been his unparalleled patience. According to Steve Check, founder of Check Capital Management, “He’s the most patient investor ever, which is a big reason for his success.” Even at 94, Buffett continues to lead Berkshire Hathaway as chairman and CEO, though Greg Abel, his designated successor, has assumed many operational responsibilities. Abel is set to oversee all investment decisions when Buffett is no longer at the helm.

Warren Buffett’s Berkshire Hathaway Surpasses Federal Reserve In U.S. Treasury Bill Holdings