Chinese electric vehicle industry faces EU tariffs amid accusations of unfair subsidies

A Chinese official has criticized the European Union’s recent probe into Chinese electric vehicles (EVs), claiming it was overly selective and therefore unreliable. The investigation, which led to the EU’s decision to impose tariffs on imported Chinese EVs starting July 4, was scrutinized by Jin Ruiting, director of the Academy of Macroeconomic Research. Jin argued in an exclusive interview with CNBC that the probe’s methodology violated World Trade Organization (WTO) rules by only examining certain Chinese companies.

The European Commission’s announcement last week came after a monthslong investigation into government subsidies that allegedly support Chinese EV manufacturers. This probe aims to mitigate what the EU perceives as unfair competition in the EV market.

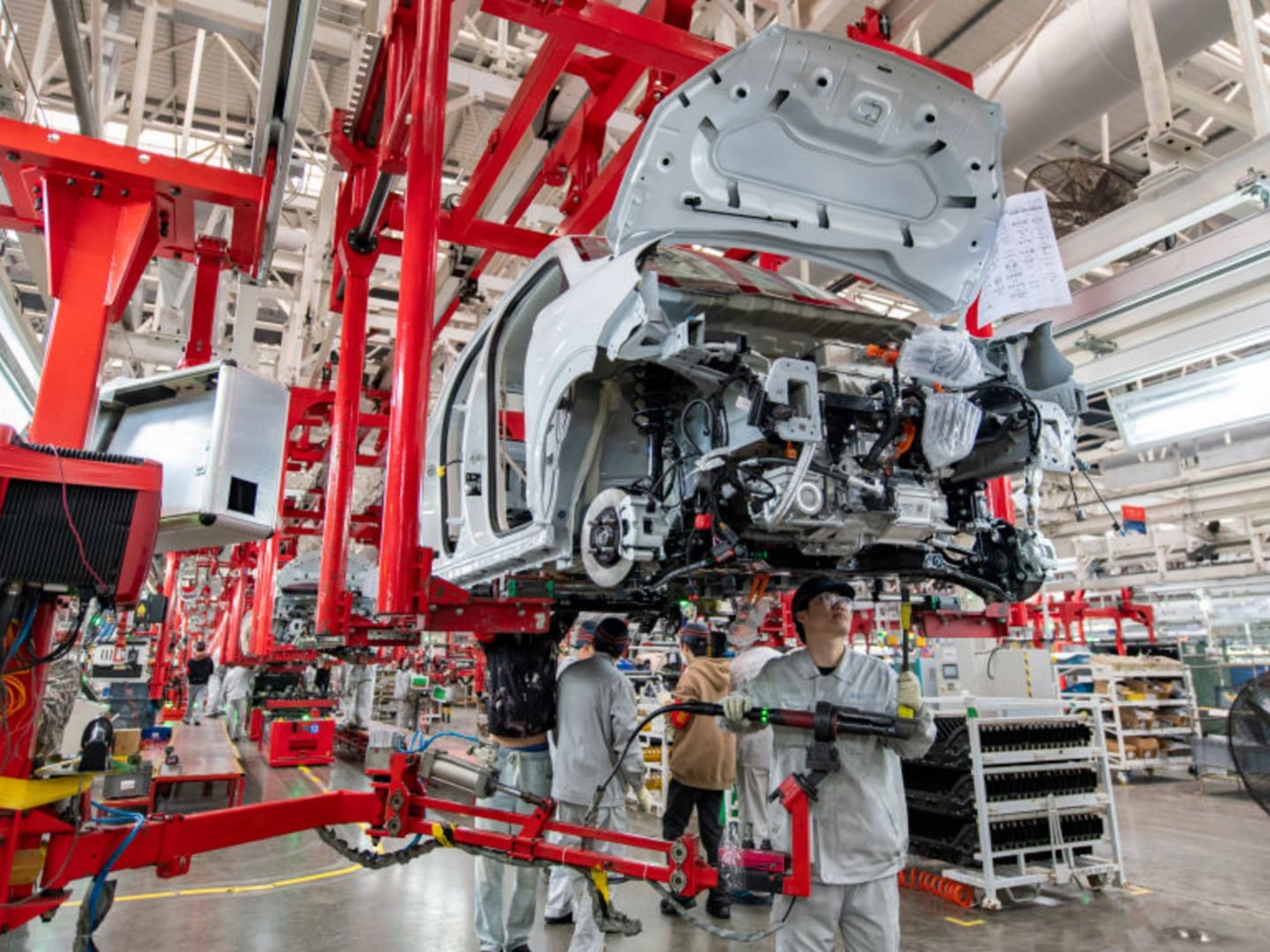

China’s electric car industry has rapidly expanded over the past decade, not only challenging domestic competitors like Tesla but also pushing traditional automakers and startups to innovate in car technology and pricing. With slowing growth domestically, Chinese EV companies have increasingly targeted international markets, including Southeast Asia, the Middle East, and Europe.

The EU’s probe has faced public backlash from Chinese officials, who deny allegations of industrial overcapacity and argue that such capacity drives global trade and economic diversification. Jin specifically noted that the EU investigation only considered a selective group of exporters, contrary to WTO guidelines that require a representative sample based on production, sales, and export volumes.

The European Commission defended its approach, with spokesperson Olof Gill stating that the sampling followed WTO rules and EU legislation, encompassing various criteria beyond export volume alone.

Prominent German automakers, heavily invested in the Chinese market, have also expressed opposition to the EU’s planned tariffs. Volkswagen, for example, highlighted the detrimental impact of these tariffs on the already weak demand for battery electric vehicles (BEVs) in Europe and advocated for open competition. Similarly, BMW warned against the protectionist spiral that tariffs could trigger.

The EU probe included major players like Tesla, which has a significant manufacturing presence in Shanghai. The Commission suggested that Tesla might face individual tariffs as part of the new measures.

Jin Ruiting criticized the transparency and credibility of the EU’s investigation, stating that it lacked an industry or business complaint basis. Despite these claims, the European Commission maintains that its regulations permit initiating such investigations without external complaints.

The planned tariffs, ranging from 17.4% for BYD vehicles to 38.1% for those from state-owned SAIC, are intended to address what the EU describes as unfair subsidization of Chinese EVs, posing a threat to EU manufacturers. Analysts from Rhodium Group have suggested that even higher duties might be necessary to deter Chinese EV exports effectively.

Meanwhile, the Biden administration has also increased tariffs on Chinese EV imports, citing similar concerns about rapid export growth and excess capacity.

Jin argued that China’s EV industry is meeting the rising global demand for electric cars, a necessity highlighted by the International Energy Agency’s forecasts for achieving net-zero emissions by 2050. He emphasized the importance of global cooperation over protectionist measures, which he believes offer only short-term political gains.