Boeing is projected to incur over $1 billion in wage-related expenses from its proposed labor contract, analysts say, though the company’s shares rose 4% on Monday amid hopes of an end to a prolonged strike.

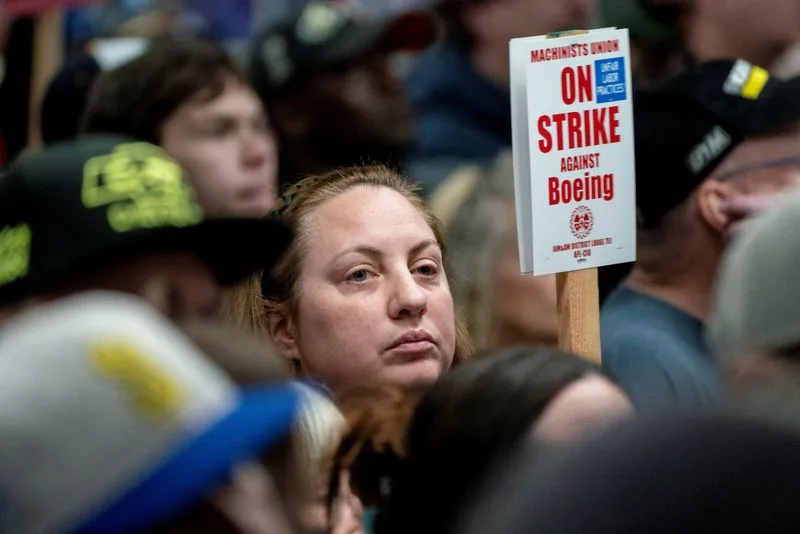

About 33,000 Boeing workers are set to vote on the contract proposal Wednesday following a month-long work stoppage that has disrupted production of key models, including the highly profitable 737 MAX narrowbody jets.

The vote coincides with Boeing’s third-quarter earnings, which are expected to show a significant loss.

“We view the proposal as a positive step,” said Ben Tsocanos, aerospace director at S&P Global, in an email to Reuters. “Resolving the strike quickly is crucial for improving Boeing’s financial outlook and supporting its credit rating.”

The new contract, announced Saturday, offers a 35% pay increase over four years, a $7,000 ratification bonus, reinstated incentive plans, and enhanced contributions to workers’ 401(k) retirement plans, including a one-time $5,000 contribution and up to 12% in employer contributions.

Although the new wage offer is better than the previous one that workers rejected, it still falls short of the 40% pay rise demanded by the Machinists’ union.

“Will the members accept? We can’t say for sure, but it seems to address nearly all the union’s requests,” said J.P. Morgan analyst Seth Seifman in a note.

Seifman estimates the proposed wage hikes could add more than $1 billion to Boeing’s costs, while Jefferies analyst Sheila Kahyaoglu projects the total wage-related expenses to be around $1.3 billion.

The agreement follows weeks of tense negotiations between Boeing and the International Association of Machinists and Aerospace Workers union. The union’s leadership faced backlash after initially endorsing Boeing’s first offer, which was overwhelmingly rejected by the workers.

As talks stalled and credit agencies warned of potential downgrades, Boeing announced plans to raise up to $25 billion through stock and debt offerings, along with a $10 billion credit line from major lenders.

Even if the new contract is approved, Boeing faces the challenge of quickly ramping up production to pre-strike levels. The halt in production has affected the 737 MAX, as well as the 767 and 777 widebody jets.

Boeing shares were trading at $161 in premarket trading. If that price holds in regular trading, it would mark the stock’s highest point since September 12, the day before the strike began.

In a separate labor development, around 5,000 workers at Textron’s facilities in Wichita, Kansas, are set to return to work after voting in favor of a five-year contract that includes 31% wage increases.