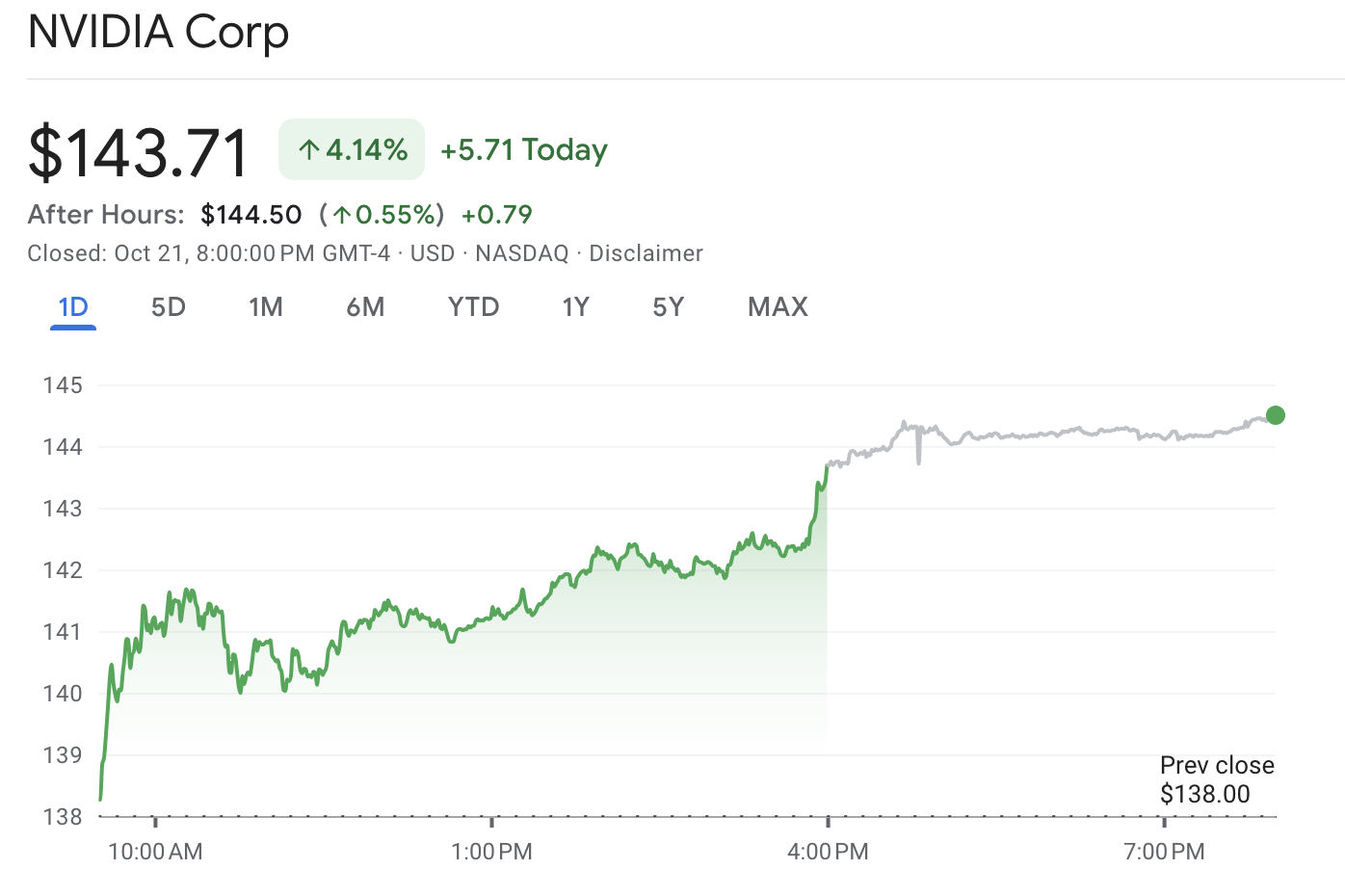

Nvidia’s stock surged to a record high on Monday, buoyed by continued confidence from Wall Street analysts ahead of the company’s upcoming earnings report in November. The AI chipmaker’s shares climbed over 4%, closing at $143.71 per share.

Wall Street analysts have reaffirmed their bullish outlook on Nvidia, driven by robust demand in the artificial intelligence (AI) sector. Bank of America (BAC) raised its price target for the stock from $165 to $190, citing the company’s dominant position in AI hardware and software. CFRA followed suit last week, increasing its target from $139 to $160. According to Bloomberg consensus estimates, analysts expect Nvidia shares to reach $148.37 over the next 12 months.

Nvidia Market Stock | Image: Google Finance | 22nd October

Vivek Arya, a Bank of America analyst, highlighted Nvidia’s strong presence in the enterprise AI market as a key factor in the stock’s rising trajectory. Arya noted that Nvidia is “the partner of choice” for enterprise AI solutions, with collaborations involving major companies like Microsoft (MSFT) and Accenture (ACN) further boosting its prospects.

Despite a brief dip last week and concerns about a potential slowdown in AI-related spending, Nvidia’s shares have risen nearly 3% in the past week and over 20% in the past month.

Nvidia CEO Jensen Huang recently remarked on the “insane” demand for the company’s AI chips, which are critical for powering generative AI in data centers for Big Tech companies. Positive earnings reports from industry partners like Micron (MU), which supplies memory chips used in Nvidia’s GPUs, and TSMC (TSM), which manufactures the chips, have also contributed to Nvidia’s momentum.