One of the key takeaways the world adopted after the COVID-19 pandemic was going contactless. When physical contact meant risking our health and the well-being of our communities, the world unanimously decided to embrace contactless interactions and transactions. Four years later, contactless payments have transformed into the new norm and often times act as a crucial metric for choosing a particular product or platform.

But the one-tap revolution is still governed by fiat currency. Every tap involves a bank and a financial intermediary that shuttle currency from a registered customer to a registered merchant. Simply put, the current one-tap landscape only recognizes fiat currency as a legitimate means of exchange or store of value. Alternative asset classes, such as tokens on the blockchain, still remain bound to multi-layered infrastructure that hinders their accessibility on the go.

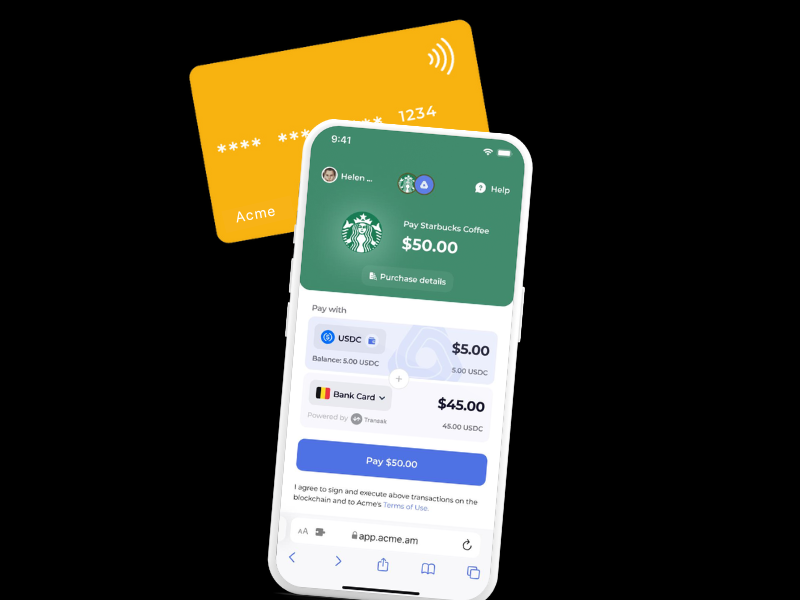

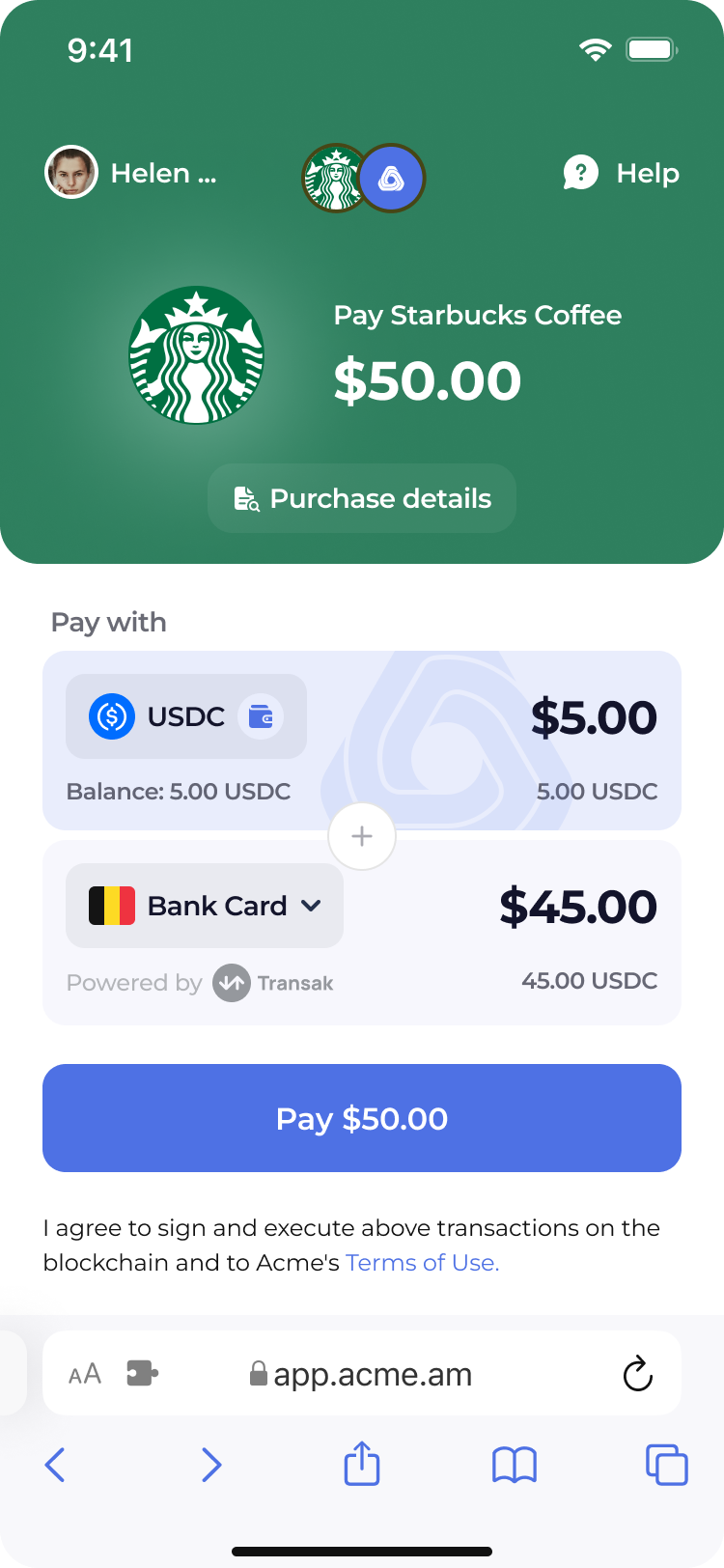

Acme, a Dubai-based blockchain service, is pioneering a radical financial future: bringing one tap to the blockchain through an intent-based network. Acme envisions a future where earning points at one merchant and spending them at others is as easy as using Apple Pay. Similar to Visa or Mastercard, Acme aims to position itself as an essential intermediary for tokenized transactions.

Brands won’t allow private points exchanges to scale. But they do want to allow spending your points at other brands: https://t.co/mSiaEX4jNt

We’re building a Global Settlement Layer for Loyalty Points at @AcmeOneTap to help you spend your miles as easily as you use Apple Pay!

— Nilesh Khaitan (@nileshkhaitan) March 19, 2024

Acme is a sum of crypto innovations under one platform

“If you look at all the different tools in the crypto space today, each one is a piece of the greater puzzle. Somebody’s building a keyboard, someone else is building a monitor, and another developer is building software. But like a Windows PC, you’ve got to put it all together to create an experience,” said Nilesh Khaitan, founder of Acme, as he described the need and drive behind such innovation.

To achieve one-tap payments on the blockchain, the systems in place must offer the perks of the crypto world and guaranteed security from the modern banking system. As the former crypto lead at Venmo and PayPal, Khaitan learned that “digital platforms where people choose to hold their money need to give them security and convenience.” Mimicking one tap for crypto transactions would mean blurring the synapse between the tap and the mechanisms that facilitate it seamlessly.

A self-custodial wallet is the crypto equivalent of a bank account or vault. Traditionally, to claim or trade tokens from a self-custodial wallet, users were required to install a metamask and carefully partake in 50 additional clicks to complete a transaction successfully. Acme condenses this cumbersome exercise into a single tap using its intent-based network.

“Intents are specific actions you want to do with your money. Whether it’s paying for a coffee or making a trade, they define precisely what you want to do, right down to the specific funds you’d like to use,” said Khaitan.

On the blockchain, there is “no concept of deposit to or withdrawal from a bank, which means your money is not in the UAE or India. Your money is always with you, which means no one can confiscate it.” Though radical in its essence, the blockchain thrives on the principle of decentralization in all respects. “[With cryptocurrency] money can be in any form. With the current banking infrastructure, you have no choice but to store your funds in a particular currency,” adds Khaitan. Tokenized assets or digital currency can be created by anyone and be stored in a live market.

To execute intents, Acme curates the cheapest, fastest, and safest route to transfer or claim tokens across various systems. Acme poses as a “well-connected friend in the financial world” that simplifies communication between users, developers, and services to execute a one-tap DeFi transaction.

With grand aspirations come great challenges

Acme’s vision to simplify the future of transactions on the blockchain is no simple feat. It demands the highest security infrastructure to build credibility and strategic branding to get the word out.

“I’m well aware about Web3 and the blockchain, so Acme’s mission is something I can envision. But what about different demographics that may not be well versed with tokenized assets? How does Acme plan on making this revolution a part of their lives?”

“Think of me as the donkey in the middle in many ways,” replied Khaitan. “I am traditional enough to translate this technology to everyday people in terms of what it means for them, and with knowledge on the fundamentals of this technology, I know exactly how it needs to work,” added Khaitan. According to Khaitan, the behind-the-scenes of one-tap payments don’t matter because for everyday people, “Visa is simple tap and pay.” People value convenience and prioritize security above all other fringe benefits.

Acme does not aim to be its own bank. It is merely a tool that helps anyone become a bank. “You never have a Visa account, right? So, think of Acme as Visa,” said Khaitan emphatically. Using Acme, “smiles can be exchanged for rupees or dollars. Just like Visa is an infrastructure that’s created for banks in 179 countries to pay using their sovereign currencies, Acme is the new Visa, through which anyone who wants to become a bank, regardless of the country and or currency, can help their customers,” Khaitan explained.

Khaitan’s Acme follows a similar business model to Visa, with a blockchain spin on it. For example, “Let’s say you’re going to buy coffee at Starbucks and it costs you AED 100. Starbucks is actually getting AED 97. AED 1 is going to Starbucks’ bank, another AED 1 goes to the customers bank, and the final dirham goes to Visa,” Khaitan illustrated.

Now let’s imagine a scenario with Acme. “If someone in Argentina used Acme to facilitate a cross-border payment of 10 silver to Mexico, for instance. The fee breakdown would stipulate that a certain fraction is given to the Argentinian bank, the Mexican bank, and Acme. However, Acme’s value add lies in its ability to make any entity a bank and earn payment fees. If a game wants to create their own gaming coins and make money using Acme, the game suddenly becomes the bank,” according to Khaitan.

Setting up operations in the UAE

The UAE is making strides in the crypto space. With transformative reforms such as legalizing cryptocurrency as a form of salary payments, school fees, and a method to purchase real state.The ease of transacting and operating in the UAE is unparalleled to the West, according to Khaitan, who spent the majority of his career in Silicon Valley.

“The UAE is strategically positioned, with a great network of commodities and liquidity” at its disposal. “I got a lot of favorable tax conditions because I’m a software company. I got a golden visa because I am an entrepreneur who’s doing some specialized work in a niche sector. These regulations show me, on a very fundamental level, that the UAE cares about me as an entrepreneur more than the US cares about me despite me spending two decades of my life out there,” said Khaitan.

The law and resources play a vital role in pioneering Acme’s radical goal. The UAE’s place in the modern cryptosphere is one of growth and innovation. It acts as a hub for talent, much like Acme, which “lives through apps and developers” on its evolving platform.