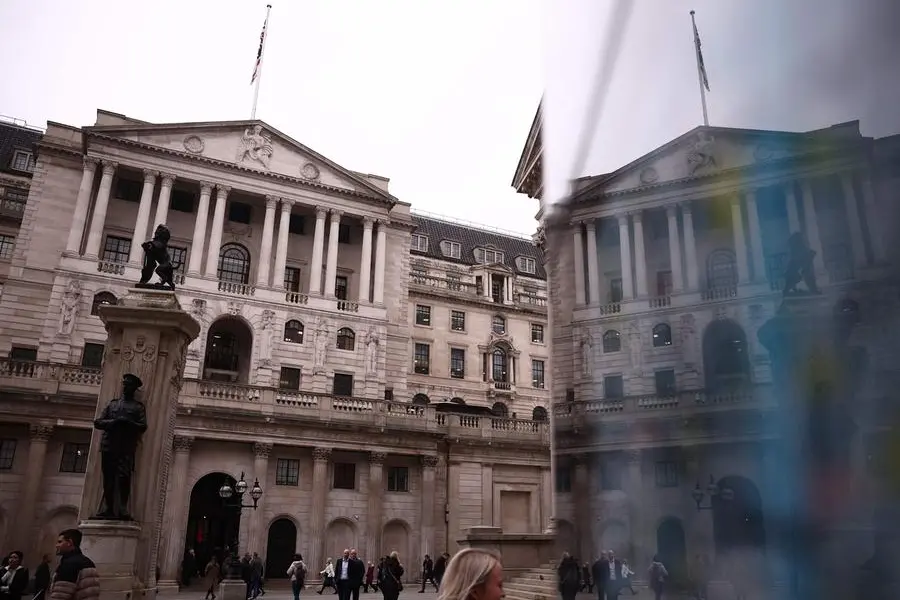

The Bank of England (BoE) has lowered interest rates by 25 basis points to 4.75%, signaling confidence that UK inflation is now close to the central bank’s 2% target. This marks the BoE’s second rate cut of 2024, following its initial move to ease rates in August.

Despite recent volatility in the bond markets triggered by new Labour Chancellor Rachel Reeves’ budget, which introduced £40 billion ($52 billion) in tax hikes, the bank proceeded with the widely anticipated rate reduction.

The BoE indicated that rates may continue to decrease gradually, provided economic conditions evolve as expected. The central bank forecasts inflation could rise to around 2.75% over the next year, partly due to a moderation in the drag from household energy costs. However, inflation is expected to return to the target level of 2% thereafter.

The bank also highlighted potential risks that could keep inflation elevated, cautioning that geopolitical events, particularly in the Middle East, could disrupt oil supplies and elevate global prices, contributing to inflationary pressures.

Neal Keane, head of global sales trading at ADSS, noted the BoE is facing a delicate balance between supporting economic stability and managing new fiscal policies. “The bank is contending with two opposing forces—declining inflation justifying rate cuts and increased government spending signaled by last week’s budget, which the Office for Budget Responsibility (OBR) projects will boost demand by 0.6%,” Keane remarked.

Given these competing factors, Keane added that the BoE may choose to leave rates unchanged at its December meeting unless economic data indicates a marked slowdown in the coming weeks.