Chinese electric vehicle (EV) manufacturer BYD has reported a significant increase in net profits for the second quarter of 2024, demonstrating strong market performance despite aggressive pricing strategies and international challenges.

View this post on Instagram

Strong Financial Performance Amid Price Wars

BYD’s net profit surged to 9.1 billion yuan ($1.3 billion) in the April-June quarter, marking a 32.8% increase from the previous year. This growth is the fastest since the end of 2023, with revenue climbing 25.9% to 176.2 billion yuan, according to a recent stock exchange filing. The company has maintained its leadership in China’s electric and plug-in hybrid vehicle sector, capitalizing on its extensive market reach and vertical integration strategy, including in-house production of key components like batteries.

Sales from autos and related products comprised 75.8% of BYD’s total revenue, with the gross margin for these products rising to 23.9% in the first half of 2024, up 3.3 percentage points compared to the same period last year. However, the gross margin dipped to 18.69% in the second quarter from 21.88% in the first quarter, based on Reuters’ calculations from BYD’s financial disclosures.

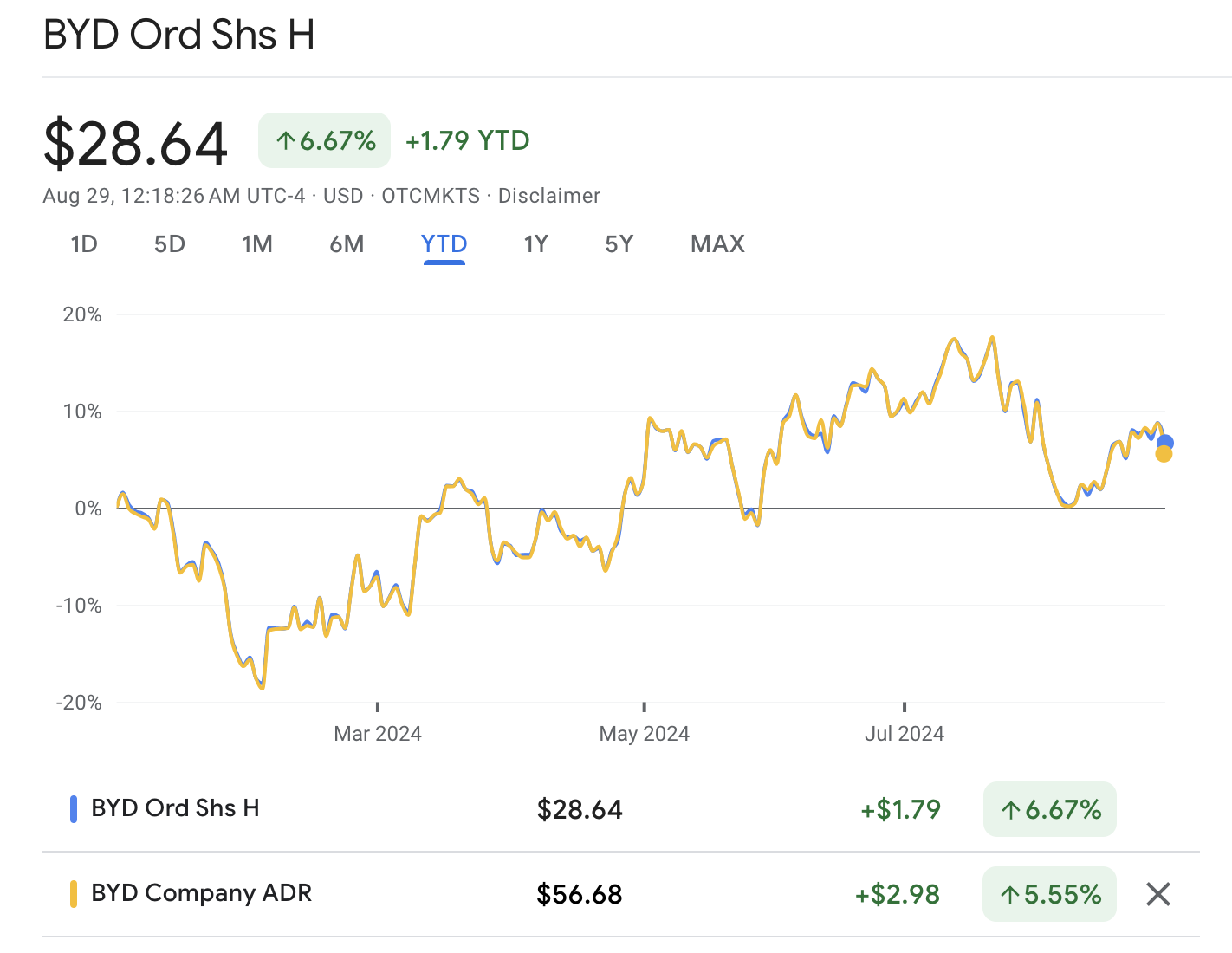

Image | Google Finance

Market Expansion & International Challenges

BYD is not only focusing on its domestic market but is also expanding internationally. The company has entered markets in Europe and Mexico, and there are plans for further manufacturing expansion. However, BYD faces a 17% additional tariff on exporting EVs from China to European Union countries, a move justified by the EU on grounds of alleged subsidies benefiting Chinese EV production—a claim denied by China’s commerce ministry.

Moreover, BYD’s expansion into North American markets faces similar challenges, with Canada and the U.S. planning additional tariffs on Chinese EV imports. Despite these obstacles, overseas shipments accounted for 11.9% of BYD’s total car sales in the first seven months of the year, nearly double from the same period last year.

Aggressive Discounts & Market Share Gains

To reinforce its leadership in China’s new energy vehicle market, BYD has implemented aggressive discounting strategies, particularly for its best-selling Dynasty and Ocean series of EVs. This tactic aims to achieve a 20% increase in annual sales for the year. As a result, BYD holds over a one-third share in China’s new energy vehicle market.

BYD has outperformed its competitors, surpassing the combined sales of Volkswagen’s two joint ventures in China by 14.5% in the first seven months. Additionally, BYD is on track to surpass Tesla as the world’s largest EV manufacturer this year, with an estimated 17.7% share of the global market compared to Tesla’s 17.2%, according to Counterpoint Research.

Focus On Premium Brands & Advanced Technologies

In addition to expanding its market share, BYD is also working to increase profitability through its three premium brands—Denza, Fangchengbao, and Yangwang. Together, these brands accounted for 5% of BYD’s total sales in the first half of the year. To stay competitive, BYD is investing heavily in intelligent features, such as advanced autonomous driving systems, by hiring thousands of engineers and collaborating with external suppliers. For example, BYD uses Momenta’s system in its Denza models and Huawei’s technology in the Fangchengbao Bao 8 SUV.

BYD’s strong financial performance, strategic discounting, and market expansion efforts have enabled it to maintain its leadership in the EV market despite significant challenges. By investing in premium brands and advanced technologies, BYD is positioning itself for continued growth and success in the global electric vehicle landscape.

Canada To Impose 100% Import Tariffs On Chinese Electric Vehicles Over ‘Unfair’ Competition