Coinbase experienced its most challenging week of the year as cryptocurrency stocks took a significant hit amid broader market declines. Bitcoin miner Marathon Digital saw its stock tumble by 20%, while a basket of crypto-related equities tracked by Schwab dropped to its lowest level since February.

The selloff reflects mounting concerns about the U.S. economy and a general downturn in risky assets, with the tech-heavy Nasdaq falling 5.8% for the week—its steepest decline since January 2022. September, historically a tough month for cryptocurrencies, added to the pressure, with Bitcoin slipping to around $54,000 after a 4% drop in just 24 hours.

The downturn was exacerbated by weak manufacturing data that spurred fears of an economic slowdown. On Tuesday, U.S. spot bitcoin exchange-traded funds (ETFs) faced their worst day in over four months, with over $287 million withdrawn collectively.

Further compounding the woes, the Bureau of Labor Statistics reported disappointing August payrolls, signaling a slowdown in the labor market. The total market capitalization of cryptocurrencies has now fallen nearly 30% from its 2024 peak of $2.67 trillion, settling at $1.9 trillion. Major altcoins such as Solana’s SOL, XRP, and Cardano’s ADA experienced declines exceeding 8% over the past week, while Ether plunged 12% to around $2,200.

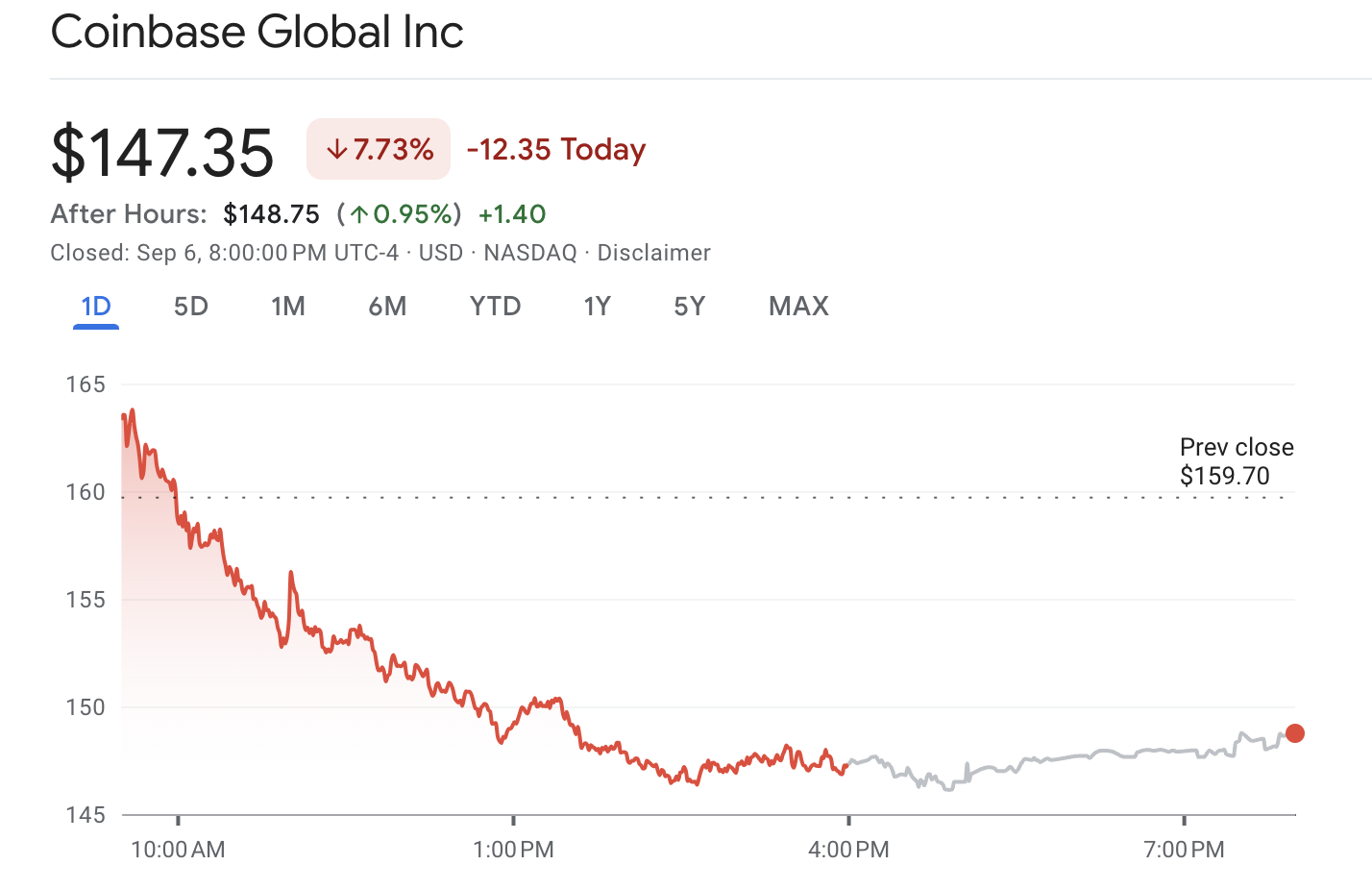

Crypto equities were hit particularly hard. Schwab Asset Management’s crypto-themed ETF (STCE), which includes Coinbase, MicroStrategy, Marathon Digital, and Riot Blockchain, fell by 11%. Coinbase’s stock plummeted 20% to its lowest point since February, amid ongoing legal battles with the SEC over alleged unregistered securities sales. MicroStrategy also suffered, dropping 14% this week following a 12% decline the previous week. Major bitcoin miners, including CleanSpark and Riot Platforms, saw their shares fall by double digits, with CleanSpark plunging 24% and Riot losing 17%.

Despite the market turmoil, JPMorgan Chase analysts noted increased trading volumes in August, with total average daily volumes up 8% from the previous month. Looking ahead, investors are focused on potential Federal Reserve actions, with speculation about a rate cut at the upcoming meeting on September 17-18. Fed Chair Jerome Powell has indicated that adjustments to interest-rate policy may be imminent, which could impact risky assets like cryptocurrencies.

Additionally, the upcoming U.S. presidential debate may influence crypto markets. Republican nominee Donald Trump’s pro-crypto stance and recent advocacy could be a positive catalyst for the industry, particularly if he were to win the presidency and remove SEC Chair Gary Gensler, known for his skeptical view of cryptocurrencies.