Money laundering is often dubbed the “washing” of illicit funds, most commonly facilitated through the purchase of real estate. However, recent shifts in money laundering trends indicate a crypto-forward approach to introducing funds into the financial system. A recent Chainalysis report analyzed the evolving trends in money laundering, in which crypto is used to conceal the origin of funds from off-chain crimes such as drug trafficking and fraud. Crypto is “cross-border, virtually instant, and generally inexpensive to transact,” making it an ideal medium for money laundering.

Findings suggest that “the growing ubiquity of crypto has made it a tool for laundering proceeds from various off-chain crimes, such as narcotics trafficking and fraud. In 2024, money laundering in crypto encompasses all crimee—not just that which is inherently tied to the crypto ecosystem.” According to the July report, money launderers utilize a combination of methods such as crypto mixing, “hops,” and cross-chain bridges between crypto wallets to conceal the flow of illegitimate funds.

Crypto mixing, or tumbling, involves mixing several crypto transactions to conceal the source and route of the tokenized asset. Cross-chain bridges allow bad actors to shuffle between different blockchain networks. Chainalysis released a similar report earlier this year, identifying the North Korea-sponsored Lazarus Group as a key player that utilizes bridges to launder stolen funds, most notably in a high-profile $100 million cryptocurrency theft from the Horizon Bridge of the Harmony blockchain in 2022.

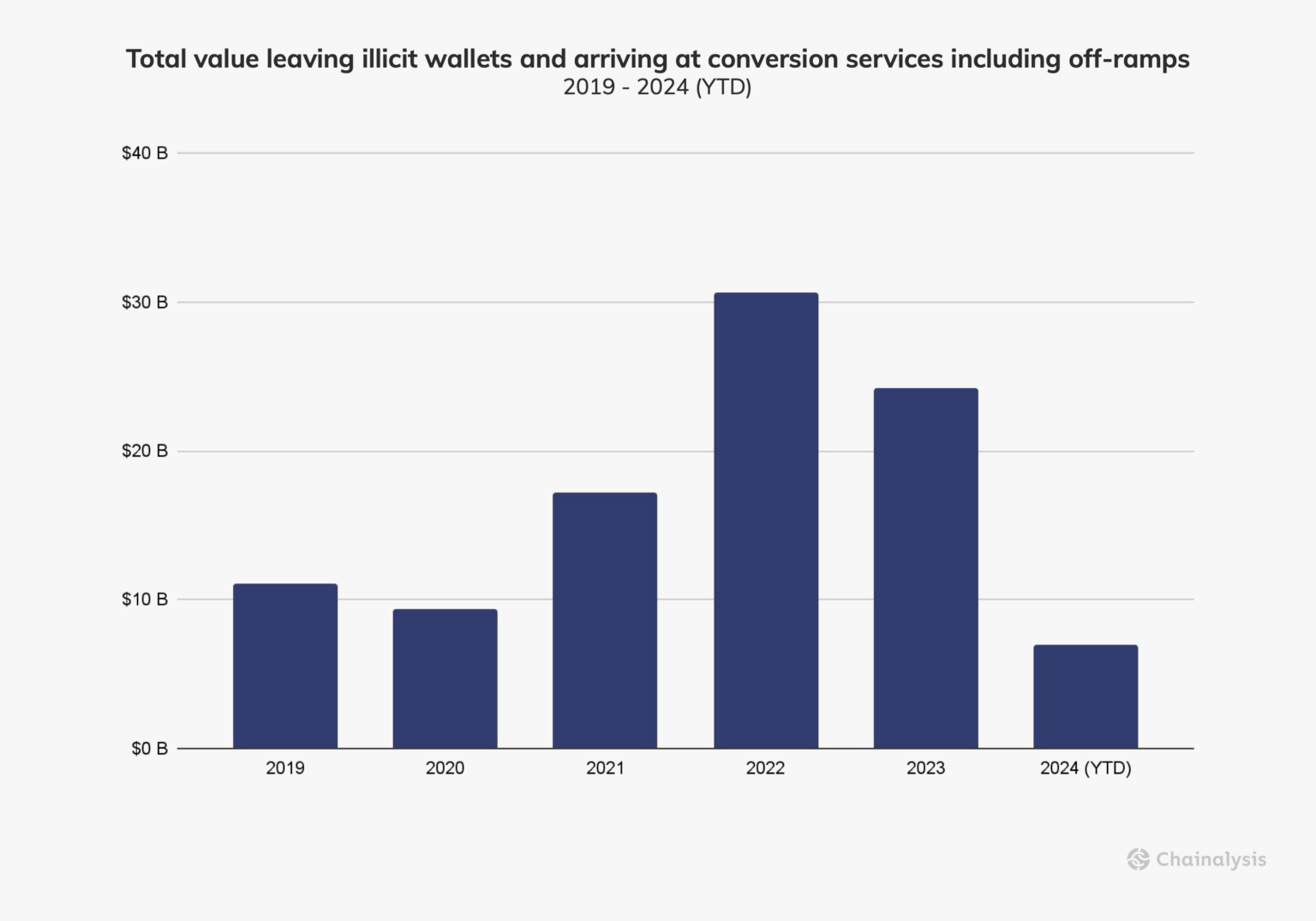

As illustrated above, nearly $100 billion in funds have been transferred from flagged wallets to conversion services in 2019. The highest amount of illicit transactions were traced back to the sanctioned Russian crypto exchange, Garantex. According to the report, “these amounts represent the dollar value of the assets at the time they leave wallets associated with illicit actors. These estimates only include the totals moved from illicit sources to crypto services and do not include the value sent and received among intermediaries—a process described below—which can include tens or hundreds of individual transactions.”

By using crypto, money launderers can evade traditional alerts that highlight suspicious transaction patterns and amounts. “If this transaction flows directly between two known exchanges, it would be indistinguishable on-chain from legitimate service-to-service transfers without specific lead information. However, investigators can still follow these funds using a combination of off-chain intelligence and on-chain analysis, and compliance teams can flag unusual transactions outside of their customers’ business profiles,” said the blockchain analytics firm in its July report.

Ambiguity coupled with loser barriers is positioning crypto as a favorable mode to launder heavy fund volumes as “illicit actors historically co-opt new technologies for their own purposes,” according to Chainalysis.