With South Africa’s central bank cutting its main interest rate for the first time in over four years, Investec, a prominent South African bank, expects credit impairments to decrease over the next year. This optimistic outlook was shared by Group CEO Fani Titi, as the bank also raised its profit forecast for the first half of the year.

The central bank’s rate cut, following ten consecutive hikes, comes as a welcome relief for the banking sector. These high interest rates, coupled with inflationary pressures and frequent power blackouts, had strained Investec’s retail and small business clients, leading to higher defaults and slower loan growth.

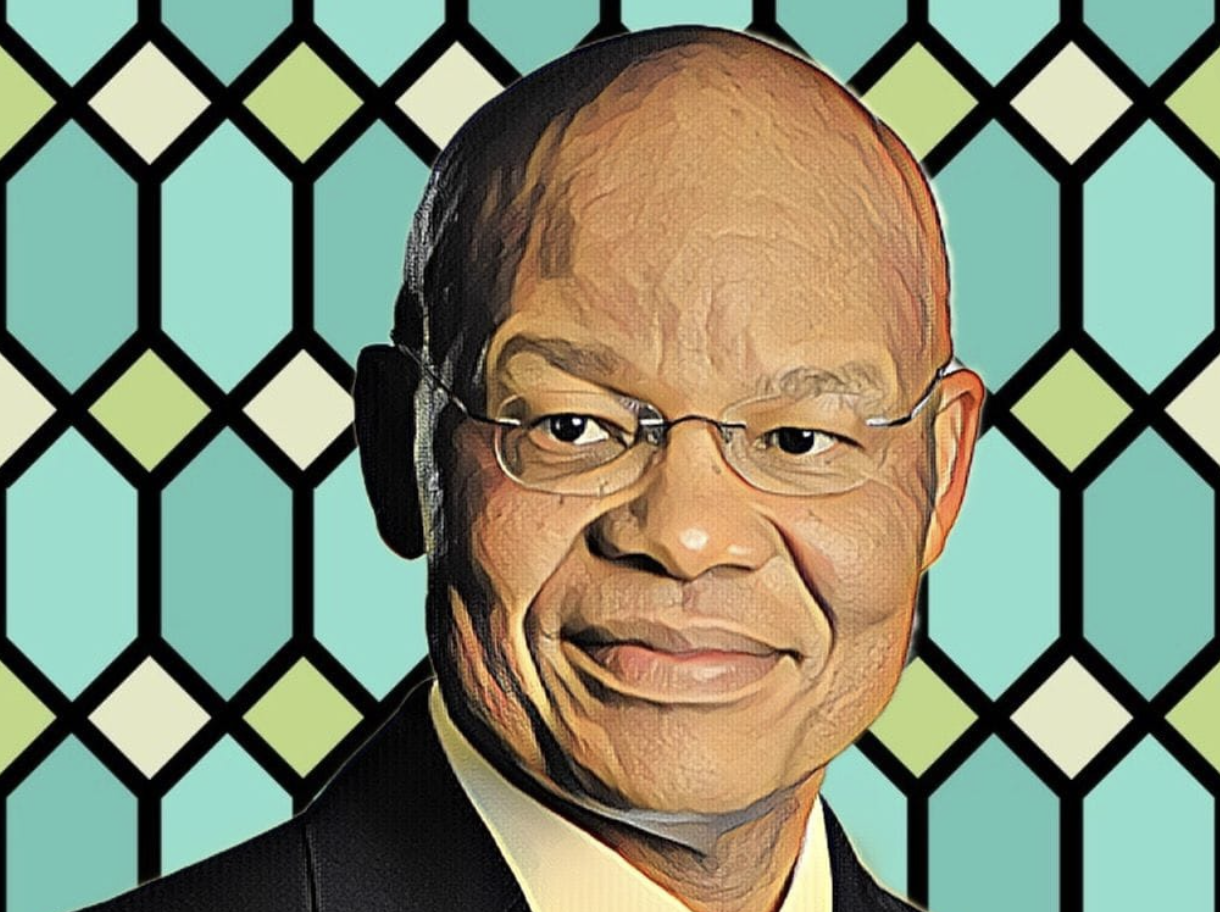

Fani Titi | Image: Billionaires Africa

Fani Titi explained that the easing of interest rates is expected to boost borrowing activity among clients and encourage companies to resume investment. “We anticipate less pressure on our clients and customers, and as a result, we expect credit impairments to unwind significantly over the next 12 months,” Titi said during a media call.

Solid Credit Quality Amid Economic Pressures

Despite the challenges of the past months, Investec reassured stakeholders that its overall credit quality remains strong. The bank reported no deterioration in its credit position for the five months ending August 30, 2024, aligning with its financial year-end report from March 2024.

Its credit loss ratio—an indicator of bad loans relative to total loans—is forecasted to remain at the higher end of its typical range of 25 to 45 basis points for the six months ending September 30, 2024. This suggests that while impairments may still be present, the bank’s credit management remains robust.

Profit Forecast Increase Amid Lower Activity

Investec’s positive outlook extends to its profit expectations. The group anticipates a rise in pre-provision adjusted operating profit, projecting a figure between £520 million and £550 million for the first half of the year, compared to £487.7 million in the same period last year. Additionally, headline earnings per share are forecasted to range between 35.3 pence and 38.2 pence, slightly up from 36.9 pence.

However, Titi noted that the early part of the five-month period saw lower-than-expected activity levels, attributed to the national elections in both South Africa and the UK. Despite this, the overall forecast suggests that Investec is well-positioned to benefit from the more favorable interest rate environment and economic stabilization in the months ahead.

A Strategic Approach To Maximizing Your Interest Earnings After A Fed Rate Cut