Emaar, Emirates NBD, and DIB saw massive drops alongside shares in ADX and Tadawul as global markets are affected by investor sentiments with Wall Street’s ‘fear index’ reaching its highest level in four years.

The Dubai Financial Market (DFM), Abu Dhabi Securities Exchange (ADX), and Saudi’s Tadawul are seeing the effects of widespread global turmoil driven by growing concerns of a US recession. Echoing the sharp declines seen in the FTSE 100 and Japan’s Nikkei 225, regional exchanges experienced significant sell-offs as investor sentiment soured.

These concerns include geopolitical tensions and fears of a US recession, with money markets predicting a 60 percent likelihood that the Federal Reserve will announce a 0.25 percentage point rate cut within a week in response to the global loss in confidence.

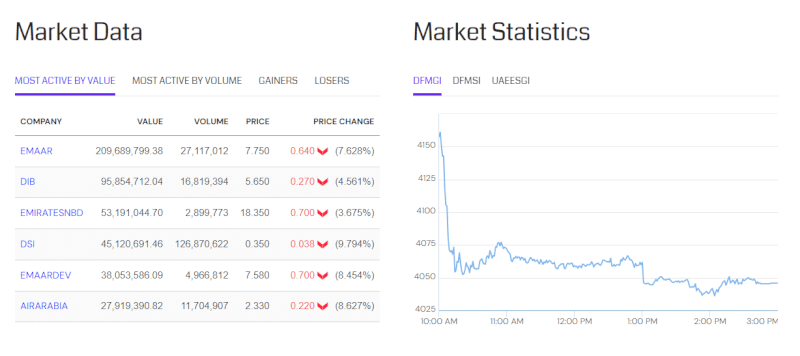

According to the Dubai Financial Market (DFM), some of UAE’s most prominent companies are experiencing drops. Emaar Properties, the Dubai-based real estate giant, saw its shares plunge by 7.628 percent, Dubai Islamic Bank (DIB), one of the region’s largest Islamic financial institutions, dropped 4.561 percent, and Emirates NBD fell 3.675 percent, followed by others including DSI and Air Arabia.

The crash is causing significant concern among investors and economists alike. The causes of this global market meltdown are multifaceted, but experts point to a storm of factors.

The Abu Dhabi Securities Exchange (ADX), in today’s index, shows a drop of over 3.417 percent, according to the latest ADX market summary. IHC saw a drop in value of 1.7 percent, Alpha Dhabi, the UAE-based conglomerate, fell 4.88 percent, followed by declines in Aldar and ADNOC Gas of 7.25 percent and 2.96 percent, respectively.

Saudi Arabia’s Tadawul main market fell by 1.96 percent. SARCO fell by 6.77 percent, Saudi Aramco saw a drop of 0.92 percent, Petro Rabigh dropped 2.52 percent, followed by drops experienced by Arabian Drilling (6.60 percent), Aldrees (3.74 percent), and Takween (6.11 percent), among others.

Wall Street’s volatility, marked by the highest level of its ‘fear index’ in four years, set off a chain reaction across global markets. The market witnessed mayhem in the morning trading hours, with widespread selling in heavyweights across sectors, traders said.

Weaker-than-expected US jobs and manufacturing data fueled concerns that the Federal Reserve might have delayed too long in cutting interest rates, posing a risk to the world’s largest economy.

The ripple effect was evident in Europe, with the FTSE 100 falling by 2.5 percent and Frankfurt’s DAX plummeting by 3 percent. India’s markets were similarly affected, with the Bombay Stock Exchange (BSE) Sensex dropping over 2,600 points and the Nifty slipping below 24,000.

The global market downturn is attributed to a much-anticipated report revealing the US economy added just 114,000 jobs last month, far fewer than expected, alongside a rise in the jobless rate to its highest level since October 2021.

Asian Markets Tank Over US Recession Fears, Indian Indices Fare Better