Nvidia (NASDAQ: NVDA), the AI chip titan, now faces a fresh challenger. Cerebras, a rising star in the artificial intelligence chip space, has filed for an initial public offering (IPO) and claims its chips can outperform Nvidia’s by up to 20 times. Nvidia has dominated the market, boasting a $3.2 trillion market cap and remarkable revenue growth of 458% over the past five years, but the competition is heating up.

Cerebras Takes Aim at Nvidia

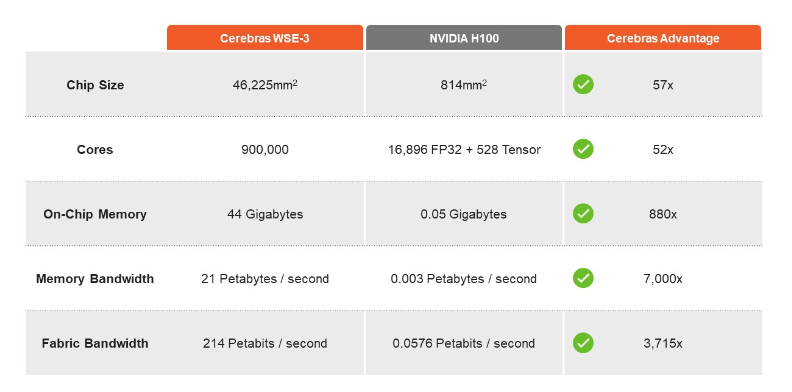

Cerebras, known for its bold innovation, has designed the world’s largest AI chip, a wafer-scale processor, which it claims moves data more efficiently than Nvidia’s top-tier H100 graphics processing unit (GPU). The startup’s chips are said to be 20 times faster at AI inference, at a fraction of the cost. With this technological edge, Cerebras hopes to disrupt the market Nvidia currently leads.

In 2023, Cerebras grew its revenue by 220%, generating $78.7 million, and has already reached $136.4 million in the first half of 2024. Despite its rapid growth, the company has yet to turn a profit, with losses of nearly $67 million in the first half of 2024.

IPO Buzz and Competitive Edge

Cerebras is targeting a $1 billion IPO at a valuation between $7 billion and $8 billion. The company’s ambitious claims, paired with the current AI frenzy, suggest there will be strong investor interest. Analysts expect Cerebras to make a splash when it goes public, potentially exceeding its valuation goals depending on market conditions.

The company’s flexible business model offers clients the choice of buying its hardware or subscribing to its cloud-based infrastructure. Cerebras also aims to make AI supercomputing more accessible by supporting familiar machine learning frameworks like PyTorch.

Nvidia Still Dominates, But the Race Is On

While Cerebras is generating buzz, Nvidia remains the dominant player in the AI chip market, with deep client relationships and a robust software ecosystem, particularly with its CUDA programming language. Although Cerebras claims its software can bypass CUDA’s complexities, it will face challenges convincing customers to switch from Nvidia’s well-established solutions.

Furthermore, Cerebras’ reliance on a single customer for the bulk of its revenue may pose risks. Nvidia’s scale and resources could allow it to adapt quickly, potentially developing similar wafer-scale chips to challenge Cerebras’ innovation.

Looking Ahead

Cerebras’ claims and upcoming IPO make it one of the most exciting developments in the AI chip space. While it may take time for the company to challenge Nvidia’s market dominance, its technological innovations and bold approach have caught the market’s attention. Investors will be closely watching to see if Cerebras can live up to its promises and become a serious competitor in the AI chip industry.