Shortly after announcing $30.04 billion in earnings on Wednesday, semiconductor giant Nvidia declared a $50 billion share buyback. This move was preceded by Nvidia’s stocks falling by 2% during regular trading, hours before the earnings report was furnished. In light of Nvidia’s impressive revenue, share prices fell by another 7% in the afterhours trade that occurred as the earnings call went on.

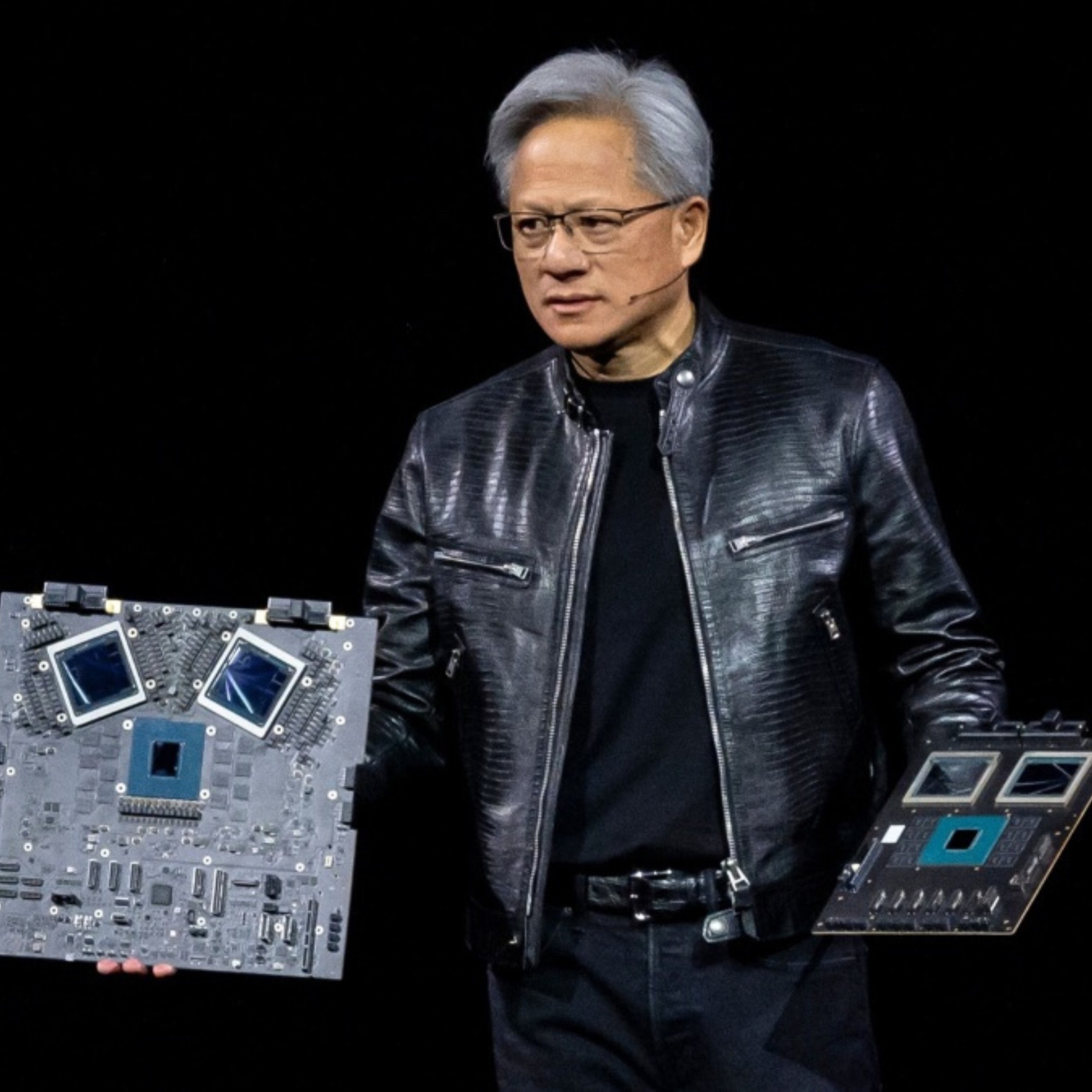

The buyback was announced alongside Nvidia’s quarterly earnings, primarily due to disappointment from higher management at Nvidia over the official release of Nvidia’s most sophisticated chip offering, Blackwell. The lack of clarity on the ‘Blackwell drop’ in the market poses as the central cause behind Nvidia’s $50 billion buyback. LSEG data highlights that Nvidia’s revenue outperformed analysts forecasts to finally settle at $30.04 billion, as opposed to $28.07 billion.

In the latest round of #MLPerf industry benchmarks, the first submission of NVIDIA Blackwell delivered up to 4X more performance on #Llama 2 70B, while the NVIDIA H200 Tensor Core GPU continued to deliver outstanding results across every data center test. https://t.co/q6C8bHyg9o

— NVIDIA (@nvidia) August 28, 2024

However, Nvidia‘s gargantuan buyback is not the largest Wall Street has witnessed. Apple’s 2024 buyback in May amounted to $110 billion. According to Nvidia’s current repurchase plan, the company still has $7.5 billion worth of stock to buyback.