The UAE is making significant strides in cementing itself as the global hub for crypto. The Federal Tax Authority in the UAE recently amended executive regulations related to VAT. Cabinet Decision No. (100) of 2024 was published on October 2nd, with more than 30 amendments across various industries. According to global auditor PwC, these “amendments aim to enhance clarity, provide further details on key provisions and procedures, and align with earlier changes in the Decree-Law and other relevant tax legislation.”

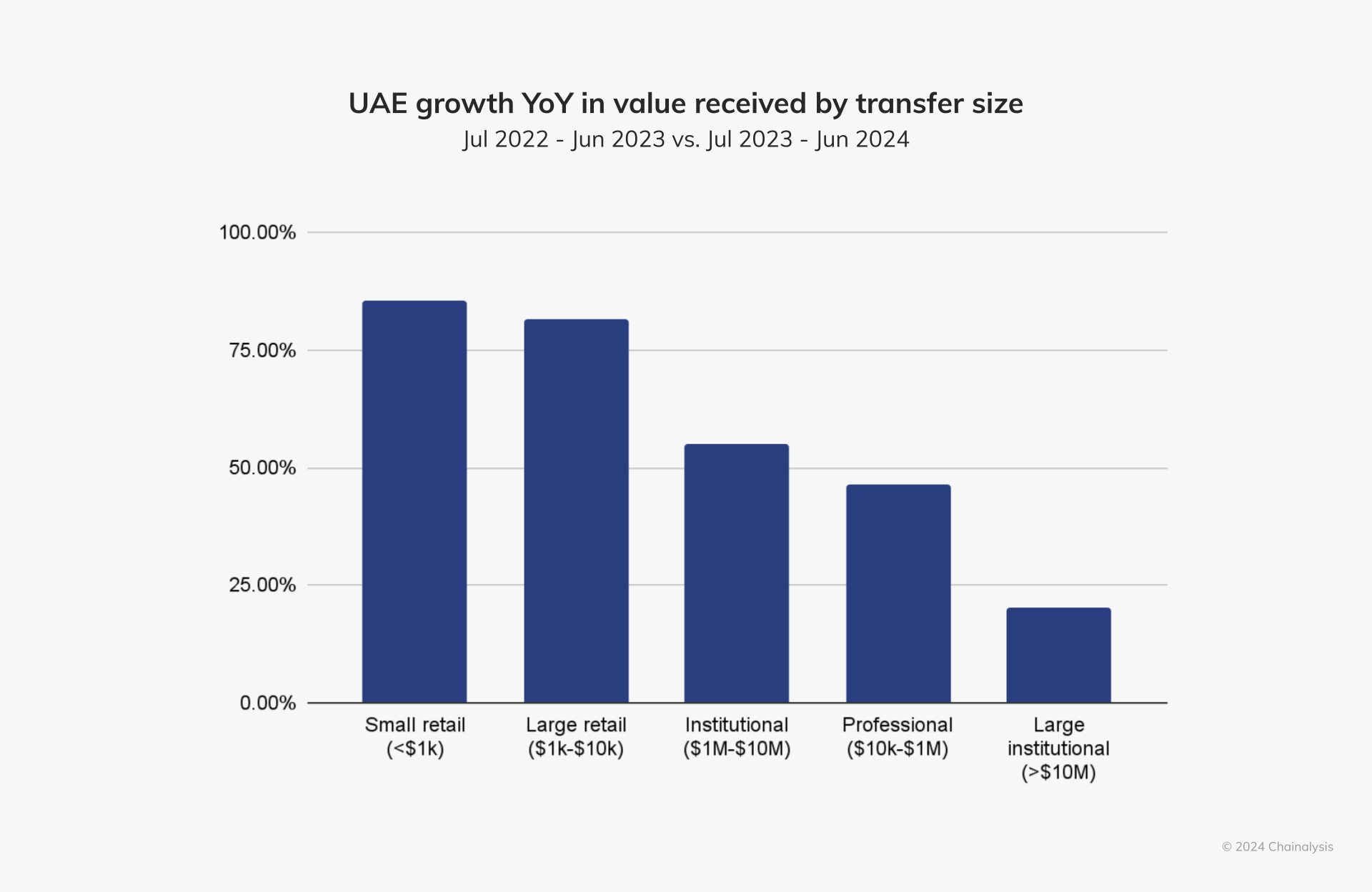

The PwC report informs that cryptocurrency transfers and the conversion of virtual assets will be exempt from VAT as of January 1st, 2018. This landmark exemption aims to attract crypto entrepreneurs and businesses to the UAE. “Between July 2023 and June 2024, the UAE received over $30 billion in crypto, ranking the country among the top 40 globally in this regard and making it MENA’s third largest crypto economy,” according to a recent MENA report by Chainylsis.

Saqr Ereiqat, CEO of TDMM, echoed the UAE’s vision to become the “blockchain capital of the world” as announced in 2016. “Fast forward to 2020, we [TDMM] signed an agreement with the Dubai Multi Commodities Centre at the sidelines of the World Economic Forum to help them build the first crypto center in the UAE,” said Ereiqat. He recalls, “The first day we [TDMM] opened for applications, we had more than 1300 applications.”

The UAE defines virtual assets as “digital representations of value that can be digitally traded or converted, and used for investment purposes. Cryptocurrencies differ from digital forms of fiat currencies or financial securities, which are treated differently under law. The amendments outline input tax recovery for crypto companies in the UAE, suggesting voluntary disclosures to “correct historic returns.”

Fund managers and companies dealing “with virtual assets” must ensure their services fall within the scope of VAT exemptions, and must be mindful of the direct impact of these exemptions on the input tax recovery process.