The UAE’s stock markets saw significant growth this week, with market capitalization increasing by AED 61 billion ($16.6 billion), largely driven by strong performances in the real estate, financial, and industrial sectors.

The Abu Dhabi Securities Exchange (ADX) accounted for the lion’s share of the gains, adding AED 52.8 billion, while the Dubai Financial Market (DFM) contributed AED 8 billion. By the close of the week, the market capitalization of listed shares had risen to AED 3.591 trillion, up from AED 3.531 trillion last Friday. ADX-listed shares now hold AED 2.858 trillion of that total, with DFM-listed shares comprising AED 733.3 billion.

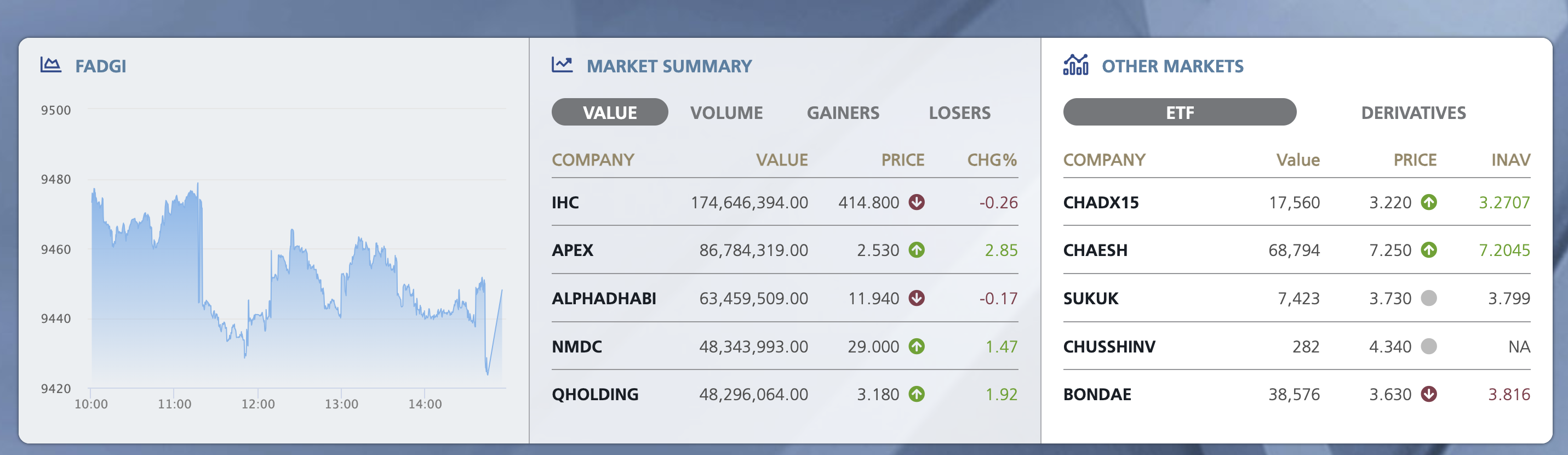

The FTSE ADX General Index (FADGI) climbed by 1.75%, or 163.12 points, closing at 9448.05 points, while the FTSE ADX 15 index (FADX15) gained 1.52%, adding 140.4 points to close at 9362.89 points.

Sector performance in Abu Dhabi showed broad-based growth, with the real estate sector up 3.1%, industrial sector gaining 2.96%, financials increasing 1.87%, and the energy sector rising 1.48%. Additionally, the telecoms sector gained 1.08%, and utilities saw a substantial 5.53% increase.

In Dubai, the General Index of the DFM advanced by 1.1%, or 47.4 points, closing at 4,372.87 points. The rise was supported by a 3.2% gain in the real estate sector, a 1.38% increase in financials, a 1.11% boost in telecoms, and a 0.48% rise in the industrial sector.

This week’s gains reflect the strength of the UAE’s stock markets, buoyed by investor confidence in key sectors as the region continues its economic growth.