As young people increasingly turn to investing to build wealth and prepare for their financial futures, the question arises: do they have the right tools and knowledge to navigate today’s complex financial landscape?

A Surge in Young Retail Investors

Innovations like no-fee trading platforms and widespread access to financial information have driven a wave of young retail investors into the market. Globally, 70% of retail investors are under 45, with significant growth seen in regions like China and India. In India alone, over 120 million retail investors joined the market between 2019 and 2023, most of them aged 22 to 35, according to The World Economic Forum’s Global Retail Investor Survey. With traditional wealth accumulation methods, like real estate, becoming less relevant, young people are increasingly turning to securities trading to build wealth and secure their financial futures.

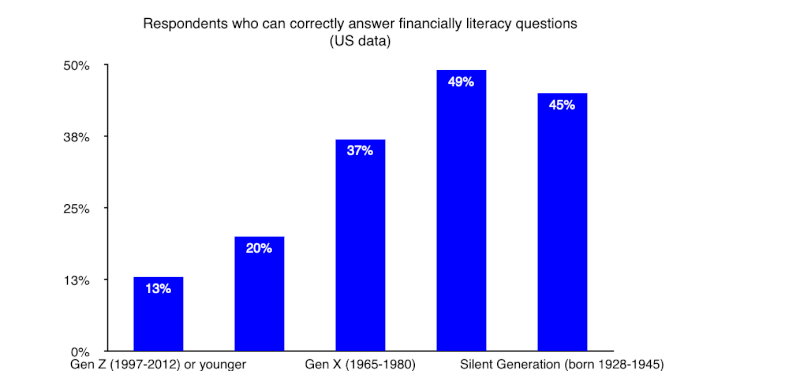

Challenges of Financial Literacy

Despite their enthusiasm for investing, many young investors lack the financial literacy necessary to make informed decisions. Only 33% of adults globally are considered financially literate, and in countries like the U.S., this figure drops to just 18.3% for individuals aged 18-34. Without a solid foundation in financial knowledge, young people may struggle with critical decisions around retirement planning, budgeting, and debt management.

The Role of Financial Education

The importance of financial literacy cannot be overstated. Studies show that individuals with higher financial literacy tend to save more, manage debt more effectively, and achieve better returns on investments. Financial education can empower young investors to understand complex financial products like exchange-traded funds, compound interest, and risk diversification—crucial tools for building long-term wealth.

Creating Accessible Financial Education

The solution lies in making financial education more accessible and engaging. Employers, policymakers, and financial institutions can play a significant role by offering educational workshops, integrating learning modules into financial platforms, and leveraging technology to make financial knowledge more approachable. For example, gamified financial education and unbiased content on popular media channels can help young people develop healthier financial habits.

As young people embrace investing, it’s critical for the public and private sectors to ensure they have the best tools to succeed in an increasingly complex financial world.